Summary

- The volatility in August was caused primarily by Treasury bonds, where such swings are automatically taken advantage of by the risk model and carry little meaning longer-term.

- Hedgewise has continued to outperform its benchmark this year after beating it by nearly 10% in 2022, which is a testament to the ongoing success of its techniques.

- The primary danger for clients is to overreact to short-term drawdowns which effectively improve the medium and long-term outlook.

Introduction: Looking Through the Noise of August

After a relatively boring summer, August arrived with a bang, especially in the Treasury market. Thirty-year yields have soared from around 3.8% to 4.3% since mid-July, despite relatively little news, and at one point surpassed their highs of last October. It has been a stressful few weeks, not least because there lacks a cohesive and rational explanation. The fact that this happened in August, when liquidity is typically thin, has only added to uncertainty and exacerbated daily swings.

While it is natural to seek an explanation, the fortunate reality is that it does not matter very much, especially from a Hedgewise perspective. For some broader context, maddening volatility has been a feature of the past twelve months. Last October, 30yr yields jumped from 3.25% to 4.25% in three weeks, only to fall back down to 3.5% a month later. A compelling rationale remains elusive and will likely remain that way. The most relevant lesson is not in explaining exactly what happened, but rather in understanding that such events are better off ignored. While this is true broadly, it is even more applicable when seen through the lens of risk management.

From a Hedgewise perspective, the main theme since last year has been how to maximize the potential upside of a recovery after successfully mitigating losses in 2022. Prior articles discussed why a choppier environment would be preferred because it would present additional opportunity for gain. While this is true across all asset classes, it is especially relevant to Treasury bonds.

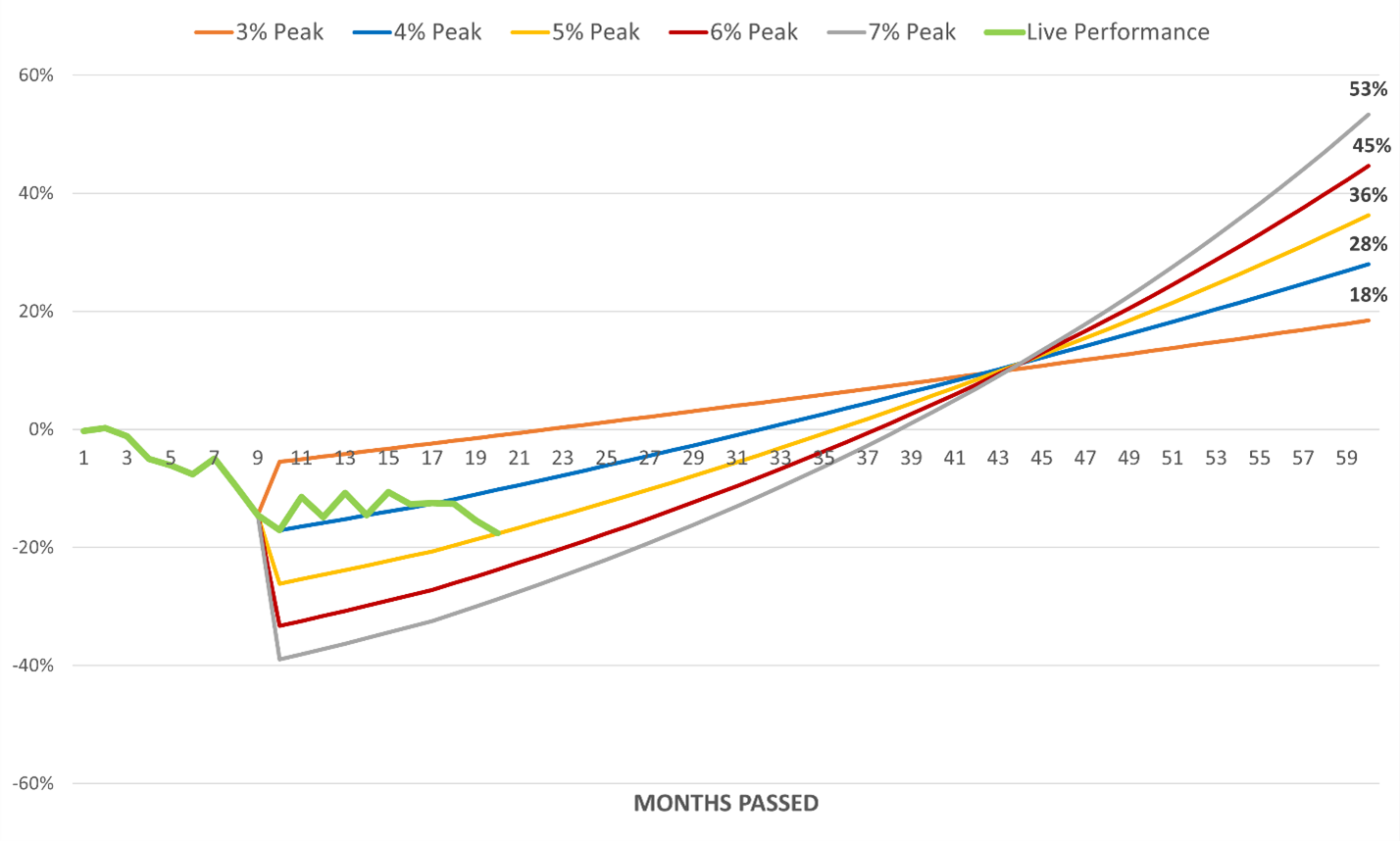

Earlier this year, the specific scenario that just unfolded in the Treasury market was modeled. The following is an updated graph that compares how bonds were expected to contribute to the Hedgewise portfolio across various interest rate peaks (assuming yields eventually settled at the long-term Fed projected neutral rate of 2.7%). Higher terminal yields resulted in higher expected terminal gains due to bigger interest payments (e.g., 5% vs 4%) and higher expected exposure levels (i.e., as yields go up, implied bond risk goes down, resulting in larger portfolio allocations). The bright green line shows how bonds have impacted the live RP Max portfolio along the way.

Interest Rate Model vs. Live Bond Performance in RP Max Portfolio, From October 2022

Up until July, Hedgewise had been hugging tightly to the 4% peak line. This was notable for how well live performance was matching the simulation, helping to validate the underlying assumptions and build confidence that the final expected gains would eventually be achieved. Over the past two months, we have hopped down to the "5% Peak" yellow line. This effectively increases the expected terminal gain from 28% to 36%, but the reality is nuanced. We can only secure that extra return if rates stay this high and continue to bounce around; that potential will disappear if rates quickly revert to the blue 4% Peak line. This explains why Hedgewise prefers bigger drawdowns that are sustained for longer in the bond market.

Of course, the key assumption is an eventual reversion of 30yr rates to 2.7%. If you know for certain rates will eventually fall to that level, it is easy to look through short-term volatility. When yields are skyrocketing like they have in the past three weeks, this may seem harder to believe. Though the case for 2.7% remains very strong, due to fundamental factors like the plateauing of the US population, the Fed's mission to keep inflation at 2%, and the self-limiting impact of restrictive rates, it is still worthwhile to play devil's advocate and imagine if rates do stay higher.

At the most extreme, let's imagine that 30yr rates rise all the way to 4.5% and never fall back down. Given that rates ended the month at 4.3%, that would imply a total additional loss of about 4%, all of which would be recovered via coupon payments in under a year. Given that, it is hard to argue that bonds are a bad investment even in this worst-case scenario. There is only additional downside if rates rise quickly and permanently above current levels (since coupon payments will continue to offset any losses over time).

The Big Picture on Bonds

With this logic in mind, the basic theme for 2023 is that bonds with 4% yields look like a great investment, and Hedgewise is much more interested in capturing future potential upside than avoiding additional downside. As yields go higher, Hedgewise simply increases its exposure further. The wrinkle is that it can feel like bad timing in the short-term despite adding to your net expected gains in the long-term.

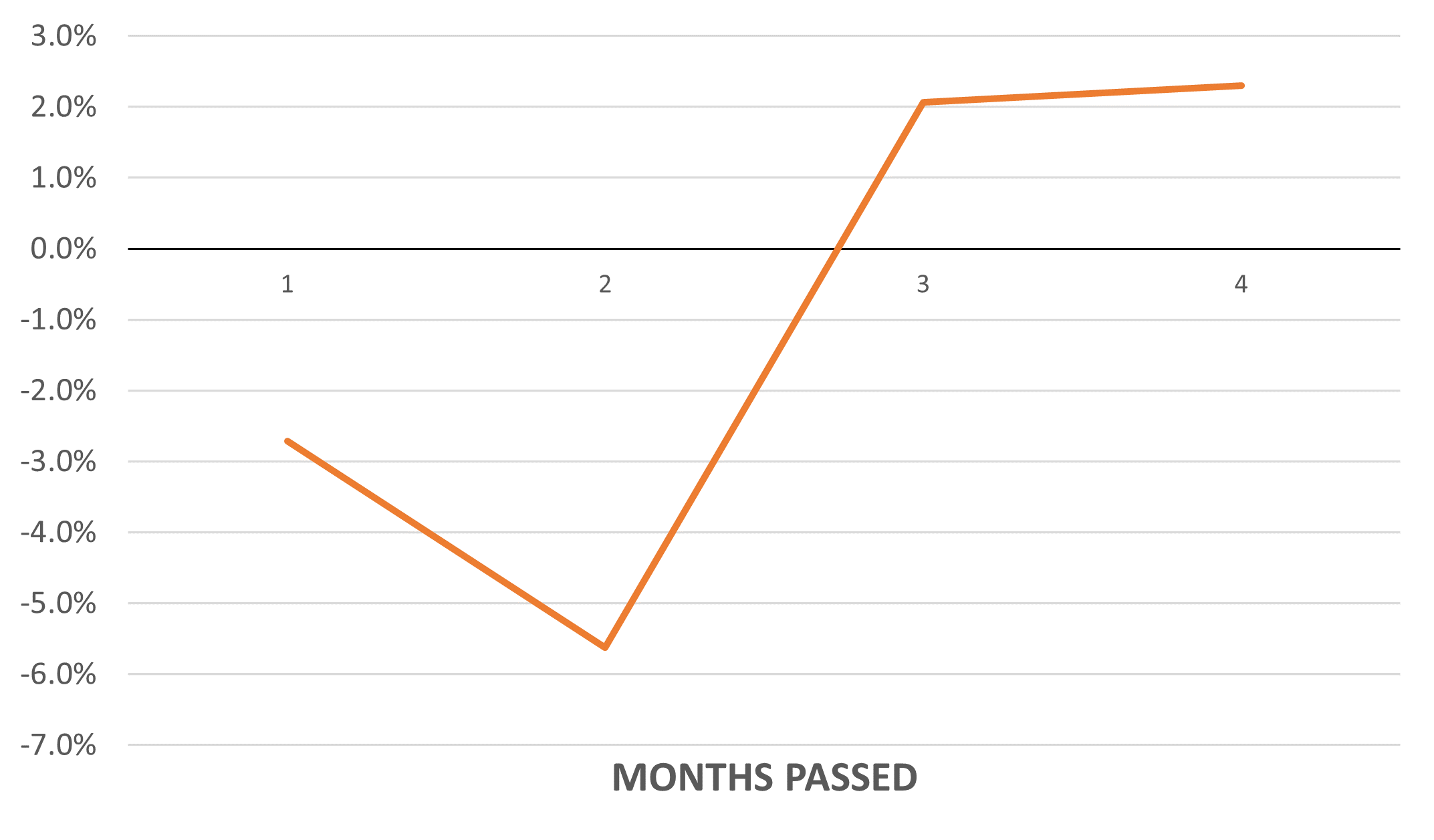

This is a mathematical illusion in a sense. Consider the following hypothetical investment scenario that tracks bond yields and portfolio allocations over four months.

| Bond Yield | Portfolio Allocation | |

|---|---|---|

| Month 1 | 4.00% | 70% |

| Month 2 | 4.25% | 80% |

| Month 3 | 4.50% | 90% |

| Month 4 | 4.00% | 70% |

At the end of four months, you get a total net gain of 2% even though yields start and end in the same place. But at the end of month 2, you have more than a 5% loss because you increased exposure as rates were rising.

Net Performance Impact of Bonds in This Scenario

This exhibits how spiking yields are positive for the portfolio but will feel negative if you freeze frame in the middle. It is crucial to keep this perspective and avoid overreacting to short-term drawdowns, especially if that is happening in the bond market when yields are elevated. This is not a case of bad timing or poor risk management, but rather the opposite.

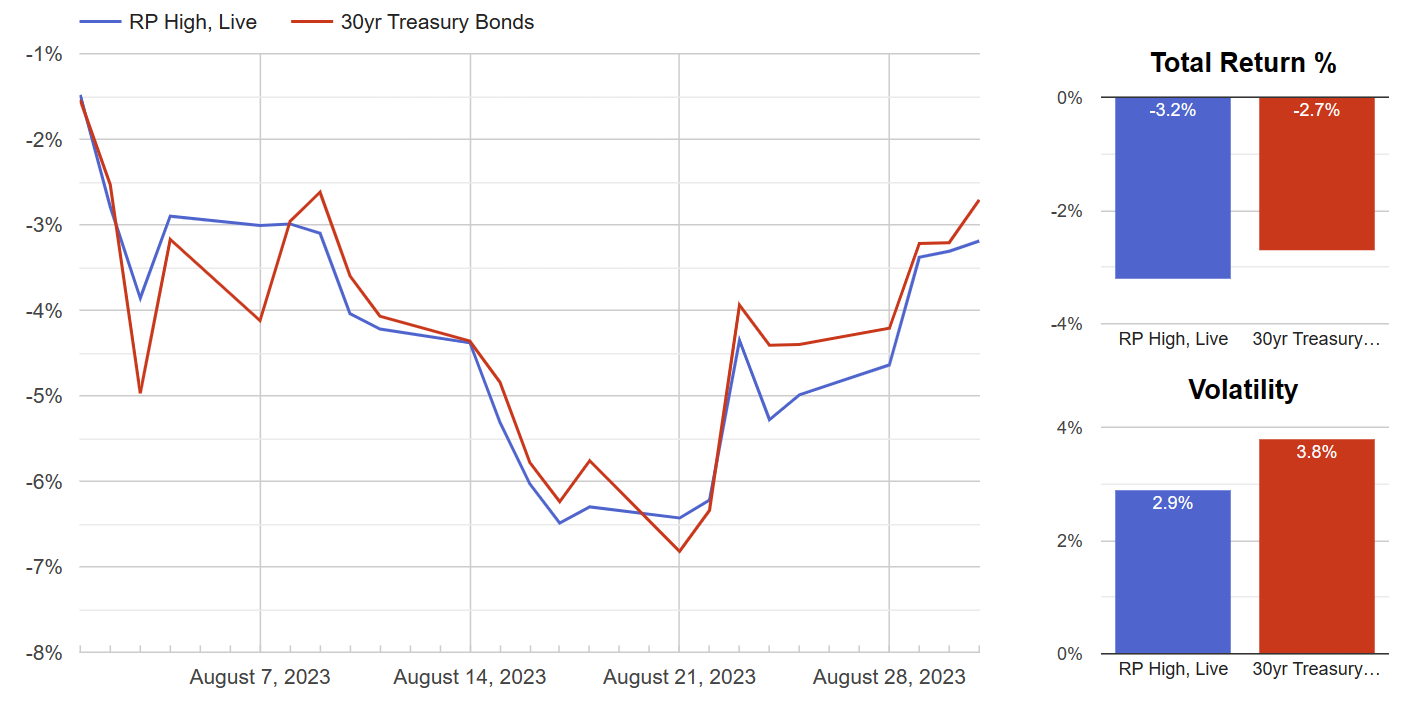

Not coincidentally, the live Hedgewise portfolio was positioned similarly to this scenario at the beginning of August, and bond yields were close to 4%. A quick look at this month's performance confirms that bonds have been the primary driver and supports the applicability of this example.

RP Max vs. 30yr Bonds, August 2023

In this new light, it should be easier to understand why such a bond-driven drawdown is not a concern for Hedgewise; in fact, it is viewed opportunistically. It would have been preferred if rates stayed as high as they were around August 20, since that would provide the opportunity to add additional exposure. Regardless, it is very human to experience significant stress and doubt at that moment, and to root for an immediate recovery, even though that would reduce expected longer-term gain.

This can be a very dangerous situation for investors, as it is precisely the wrong time to consider selling even if rates plateau or move higher. The only exception would be if rates were going to permanently settle at a higher level and never again fall below where they are today. If either of those conditions fail, Hedgewise will inevitably capitalize on this volatility, and it is just a matter of when.

In addition, from a common sense perspective, it is helpful to understand relative positioning in the live portfolio. In August, bond exposures were very close to the historical average. From a risk perspective, this means the model was assigning around a 50% chance that rates had peaked, which is no more than a coin flip. This leaves plenty of room to add exposure if yields continue to rise, and it also helps to highlight that this is not an aggressive stance.

It can be challenging to shift the mindset for bonds in this way because the implications are counterintuitive. Larger short-term losses beget larger long-term gains which would not be possible without the interim drawdown. The expected opportunity will grow as the drawdown increases. Yields need to stay elevated for months to allow this process to successfully play out. Short-term performance is not meaningful because all that matters is the terminal interest rate. Any time spent above that level is opportunity in waiting, and Hedgewise will be systematically taking advantage of it.

In short, you would need a projection of 5%+ interest rates that last indefinitely and without interruption to justify worrying about this bond volatility. This would imply some combination of a permanently restrictive rate, failure of the Fed to achieve 2% inflation, and successful avoidance of any future recession in the US that would cause the Fed to make substantial cuts.

Evaluating Performance and Wrapping Up

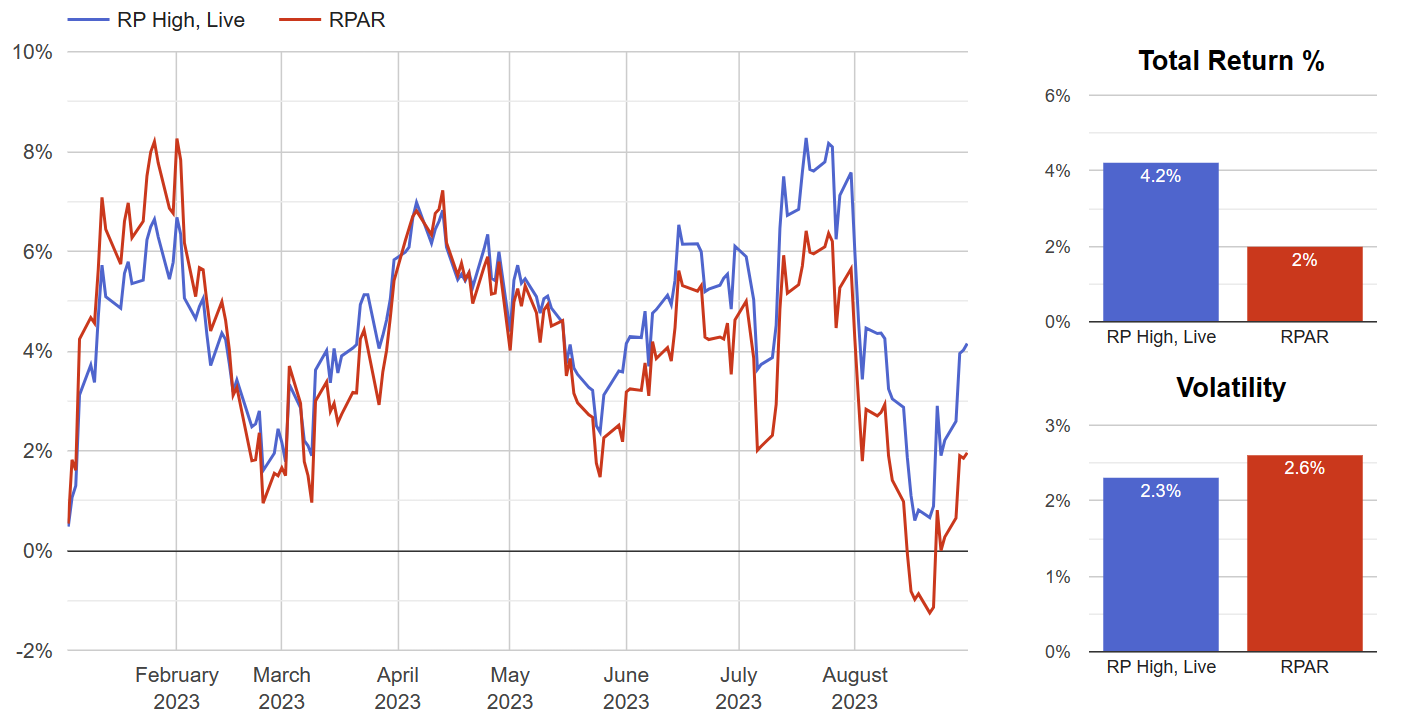

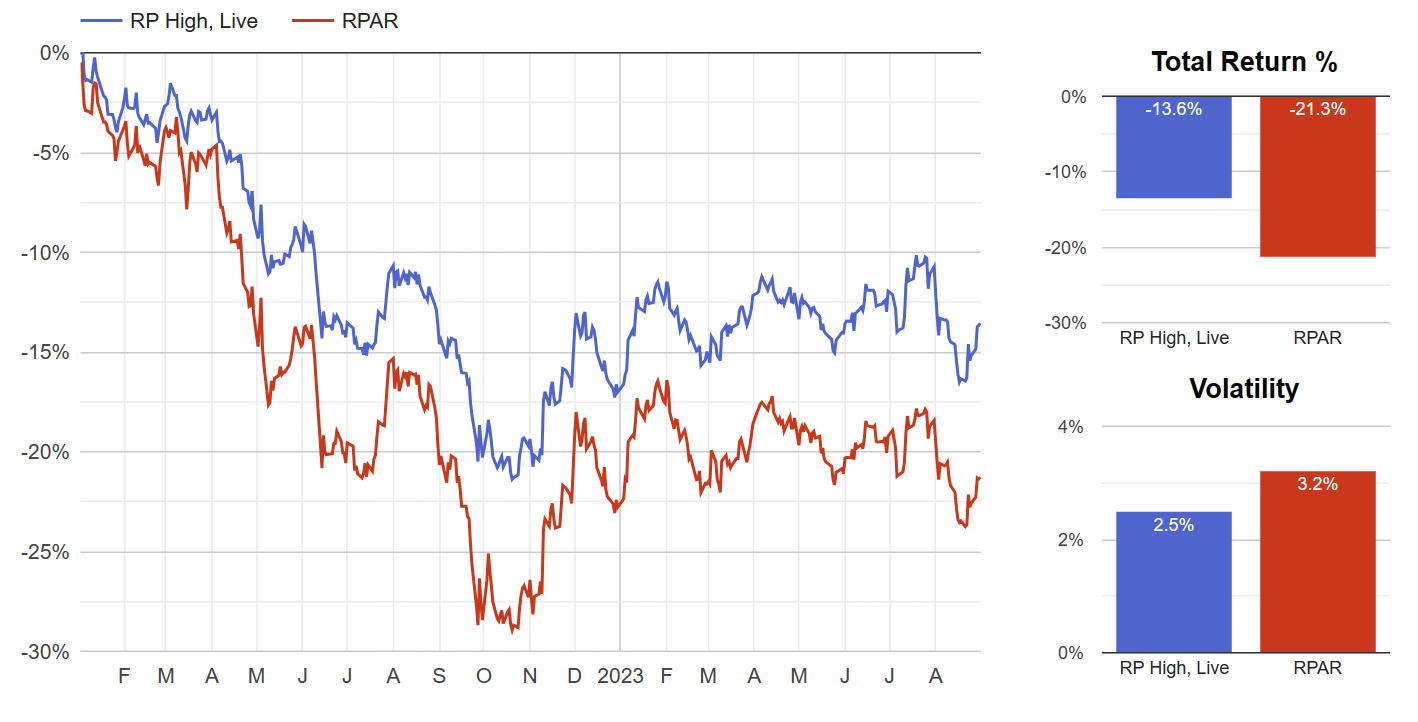

Another tricky element of this framework is that its success does not show up in short-term performance. Rather, it builds over time as Hedgewise takes advantage of volatility. This year has presented a great testing ground for that, as rates have bounced around significantly since January. One way to measure the framework's success is by comparing how Hedgewise has done vs. a passive Risk Parity framework like the RPAR ETF, which holds a more static bond allocation and thus does not benefit from higher short-term rates.

Hedgewise vs. RPAR, January 2023 to Present

Hedgewise has achieved outperformance of over 2% in a relatively short timeframe, and a large piece of that can be attributed to the bond framework just discussed. This differential is much more important than any of the short-term swings, which have been driven largely by interest rates and belie the persistent longer-term recovery potential. Speaking of that, nothing that has happened this year threatens the expected ~40% recovery discussed in the last article. That was based on an eventual return to asset price levels as of January 2022, which included yields returning to the estimated neutral level of 2.7%. Bonds now have an opportunity to increase this total potential because of the rise in rates this month - provided they can stay high for long enough!

This article has focused deeply on bonds because that asset class has been the driver of most of this year's volatility. However, an equally important theme happening behind the scenes is the normalization of exposure across all assets, including equities and commodities. In 2022, Hedgewise was successful in minimizing its drawdown because it was broadly underweight exposure. This could only translate to net new gain if it returned to neutral or overweight prior to each asset's recovery, which has already largely happened. As a result, last year's relative outperformance has persisted into 2023.

Hedgewise vs. RPAR, January 2022 to Present

So long as you can step back from the short-term swings, everything has gone almost exactly as it should in terms of risk management. After a year like 2022, when so many assets have gotten cheaper at once, the preponderance of risk shifts to the ability to participate in any recovery. Considering that alongside the design of the bond framework discussed earlier, this volatility in August is neither a surprise nor a problem. The biggest challenge is remembering that even when yields are jumping and the collective investment community is panicking about the future of fixed income.

Looking forward, the themes have not really changed since the start of the year. Hedgewise continues to prefer a choppier, slower recovery. While asset exposures have all returned near average, there is still opportunity to increase weights further as risk settles or additional drawdowns occur. The possibility of a "higher-for-longer" Fed fits right into this narrative. It should help to more fully stabilize inflation, wring out remaining excesses of fiscal spending and post-pandemic bubbles, and encourage additional market volatility. All in all, Hedgewise had a pretty good August and maintains an excellent medium-term outlook. It just isn't something measured in month-to-month performance.

Disclosure

This information does not constitute investment advice or an offer to invest or to provide management services and is subject to correction, completion and amendment without notice. Hedgewise makes no warranties and is not responsible for your use of this information or for any errors or inaccuracies resulting from your use. Hedgewise may recommend some of the investments mentioned in this article for use in its clients' portfolios. Past performance is no indicator or guarantee of future results. Investing involves risk, including the risk of loss. All performance data shown prior to the inception of each Hedgewise framework (Risk Parity in October 2014, Momentum in November 2016) is based on a hypothetical model and there is no guarantee that such performance could have been achieved in a live portfolio, which would have been affected by material factors including market liquidity, bid-ask spreads, intraday price fluctuations, instrument availability, and interest rates. Model performance data is based on publicly available index or asset price information and all dividend or coupon payments are included and assumed to be reinvested monthly. Hedgewise products have substantially different levels of volatility and exposure to separate risk factors, such as commodity prices and the use of leverage via derivatives, compared to traditional benchmarks like the S&P 500. Any comparisons to benchmarks are provided as a generic baseline for a long-term investment portfolio and do not suggest that Hedgewise products will exhibit similar characteristics. When live client data is shown, it includes all fees, commissions, and other expenses incurred during management. Only performance figures from the earliest live client accounts available or from a composite average of all client accounts are used. Other accounts managed by Hedgewise will have performed slightly differently than the numbers shown for a variety of reasons, though all accounts are managed according to the same underlying strategy model. Hedgewise relies on sophisticated algorithms which present technological risk, including data availability, system uptime and speed, coding errors, and reliance on third party vendors.