Summary

- Long-term government bonds lost over 9% in November, the second largest monthly loss since 1950.

- Hedgewise algorithms automatically detected this risk and moved out of long-term bonds ahead of time, which significantly reduced losses in client portfolios.

- Dynamic risk management will continue to protect the gains of this year, and to take advantage of higher yields and more attractive valuations when the bond market stabilizes.

Hedgewise Avoids Post-Election Bond Correction; Remains Up Over 10% YTD

The result of the election caught many investors off-guard, as most expected equities to collapse and safe-haven assets to soar if Trump won. However, his policy mash-up of "conservative populism" has most investors betting on heavy infrastructure spending, reduced taxes, and higher deficits. This has led to a dramatic crash in government bond prices along with a stronger dollar, which has lowered the value of commodities like gold.

While many Risk Parity mutual funds performed poorly as a result, Hedgewise algorithms nimbly avoided most of the losses in government bonds as a result of the improved risk framework rolled out over the summer. This provides another excellent, real-life example of how the system protects clients from drawdowns regardless of the environment, and further pierces the myth that Risk Parity is overly sensitive to interest rates. By managing risk intelligently, Hedgewise locked-in gains as bonds rallied through the first half of the year, while largely avoiding the subsequent reversal.

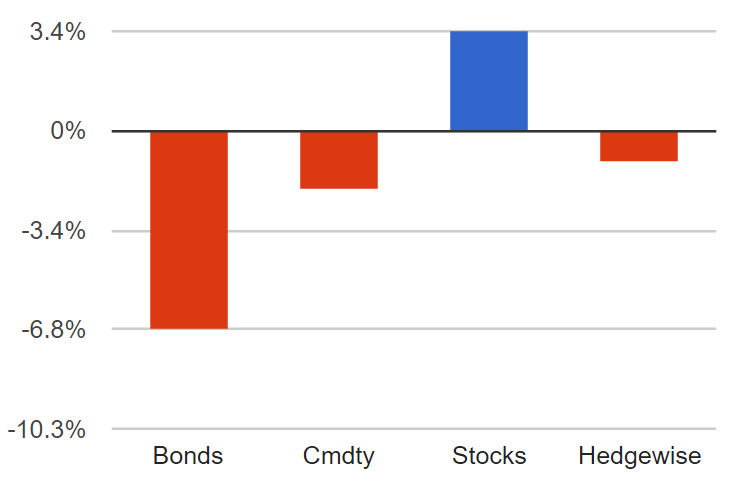

In November, Hedgewise portfolios were down approximately 1%. For comparison, a number of Risk Parity mutual funds lost 5% or more.

October Performance Summary, Indexes vs. RP High

Hedgewise Significantly Reduced Bond Exposure As Risk Increased

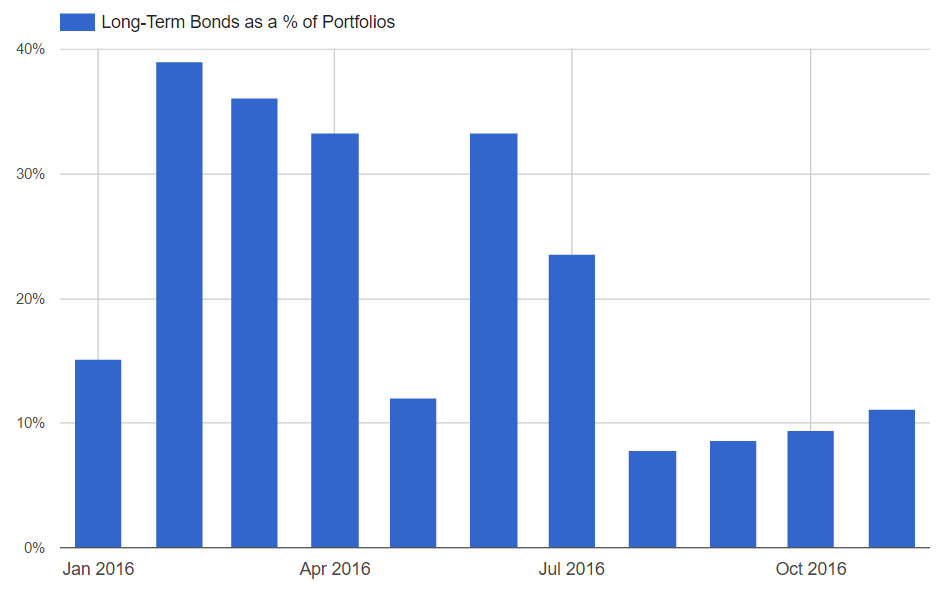

From January to June of this year, bonds gained over 15% and were one of the main drivers of outperformance for Hedgewise clients. However, as interest rates continued to fall, the risk of a reversal began to rise. The Hedgewise system is constantly monitoring such risks, which led to a dramatic reduction in long-term bond exposure beginning in August.

Long-Term Bond Exposure By Month

These adjustments have helped Hedgewise maintain its strong performance in 2016 despite a complete reversal in the bond market.

Looking Forward, Bonds Will Present Another Opportunity

Though asset class corrections typically result in mild losses for Hedgewise portfolios, they also create significant opportunities for future gain. In the bond market, for example, interest rates are now rising to much healthier levels, and will likely present an attractive entry point when the market stabilizes. This pattern helps explain why Hedgewise portfolios are so resilient. The algorithms are built to avoid the largest asset losses, but then to take advantage of the attractive valuations that ensue.

That said, it is never fun to lose money as we have for the last few months. Historically, however, there are many reasons to believe this will not last much longer or get much worse. Most significantly, the Hedgewise model portfolio has never experienced a maximum drawdown that exceeds the gains of this year. In the Risk Parity "High" portfolio, performance peaked near 14% in September, and has since given back about 3% or so. However, the maximum model drawdown (tested back to 1972) is a little over 12%. This means that if history is any guide, clients will never lose more than they gained in just one year.

It is important to reflect on this last point, as it helps demonstrate how drastically the odds are stacked in your favor. Many clients struggle to invest aggressively because of the fear of an upcoming crash, but within the Hedgewise framework, you will frequently make enough in a single year to offset even the worst-case scenarios. Given that, it really never makes sense to wait on the sidelines.

Disclosure

This information does not constitute investment advice or an offer to invest or to provide management services and is subject to correction, completion and amendment without notice. Hedgewise makes no warranties and is not responsible for your use of this information or for any errors or inaccuracies resulting from your use. Hedgewise may recommend some of the investments mentioned in this article for use in its clients' portfolios. Past performance is no indicator or guarantee of future results. Investing involves risk, including the risk of loss. All performance data shown prior to the inception of each Hedgewise framework (Risk Parity in October 2014, Momentum in November 2016) is based on a hypothetical model and there is no guarantee that such performance could have been achieved in a live portfolio, which would have been affected by material factors including market liquidity, bid-ask spreads, intraday price fluctuations, instrument availability, and interest rates. Model performance data is based on publicly available index or asset price information and all dividend or coupon payments are included and assumed to be reinvested monthly. Hedgewise products have substantially different levels of volatility and exposure to separate risk factors, such as commodity prices and the use of leverage via derivatives, compared to traditional benchmarks like the S&P 500. Any comparisons to benchmarks are provided as a generic baseline for a long-term investment portfolio and do not suggest that Hedgewise products will exhibit similar characteristics. When live client data is shown, it includes all fees, commissions, and other expenses incurred during management. Only performance figures from the earliest live client accounts available or from a composite average of all client accounts are used. Other accounts managed by Hedgewise will have performed slightly differently than the numbers shown for a variety of reasons, though all accounts are managed according to the same underlying strategy model. Hedgewise relies on sophisticated algorithms which present technological risk, including data availability, system uptime and speed, coding errors, and reliance on third party vendors.