Summary

- Gold is an excellent addition to any portfolio as a hedge against inflation and recessions.

- While the most popular gold ETF physically holds the metal, there is often a hidden benefit to using gold futures contracts instead.

- By using a switching strategy between physical gold and futures contracts, you may be able to boost the return on your gold investment by as much as 5% annually.

- We give you free access to a daily monitor that tracks the current optimal gold investment strategy.

Introduction

As written in a few of our other articles, gold is generally an excellent part of any well-diversified portfolio. It tends to spike when markets are crashing or when inflation is taking off, which are typically the environments when such a hedge is most desperately needed. However, many investors are missing out on additional gold upside that can be gained by using the gold futures market rather than physically holding the metal.

The SPDR Gold Trust (GLD) is far and away the most popular gold ETF, with over $28b in assets. The ETF basically stores gold at a secure facility, making it a fairly close proxy to simply buying a gold bar and putting it in your safe. While this is quite straightforward, it is not always ideal to simply buy and hold the metal. By understanding and monitoring the gold futures market, you can frequently get an extra boost to your gold return, either by investing directly in futures contracts or by using the PowerShares DB Gold ETF (DGL).

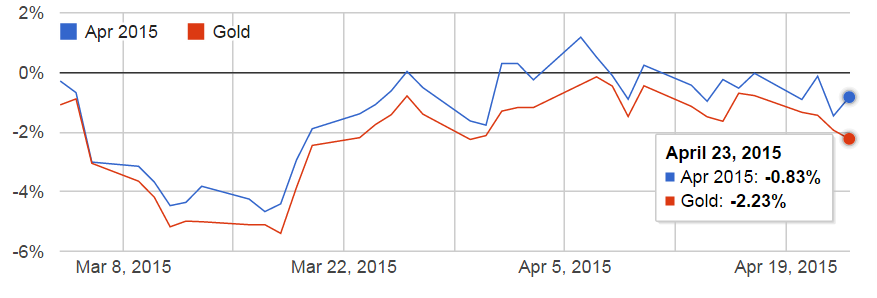

We'll break down how this works and when it makes sense to switch into futures. To give you a quick example of the effectiveness of the strategy, here's an example of how the April 2015 futures contract performed compared to the gold benchmark price over the past two months.

Performance of April 2015 Gold Futures Contract vs. Gold Spot Price, March-April 2015

Understanding the Futures Market

A gold futures contract is an agreement to buy or sell gold at a specific price at some point in the future. This 'future price' is almost always different than the current spot price, meaning that the market has an expectation for which direction the price is going to go. If the future price is less than the spot price, this is called "backwardation", and it means the market is expecting that the price will go down. Conversely, if the future price is more than the spot price, this is called "contango".

When the market is in backwardation, you can basically buy gold at a discount. For example, say you can buy a futures contract next month for $1,100 but the spot price of gold is $1,150. Even if the price of gold stays exactly flat, you would still make $50 on that contract.

To give you a sense of how varied futures prices can be, here is a snapshot of gold futures quotes on April 27, 2015.

Gold Futures Quotes, April 27, 2015

| Futures Contract | Price | DGL holdings |

|---|---|---|

| Apr 2015 | $1175.20 | |

| May 2015 | $1174.80 | |

| Jun 2015 | $1175.00 | |

| Aug 2015 | $1176.00 | |

| Oct 2015 | $1176.80 | |

| Dec 2015 | $1177.70 | 100.00% |

| Feb 2016 | $1178.50 | |

| Apr 2016 | $1179.40 | |

| Jun 2016 | $1180.30 | |

| Aug 2016 | $1181.40 | |

| Oct 2016 | $1182.70 | |

| Dec 2016 | $1184.10 | |

| Feb 2017 | $1185.80 | |

| Jun 2017 | $1189.20 |

Examining this data, you can see that the May 2015 contract is currently the cheapest, trading around $1,175. If the spot price of gold were currently higher than that, the futures contract would be a better investment than buying the physical metal.

Implementation and Caveats

With this in mind, the strategy is quite simple: monitor the futures curve, and switch between GLD and the cheapest futures contract depending on current prices. Whenever you are able to buy a futures contract at a 'discount', you will likely achieve a higher overall return than you could have otherwise.

In the example at the beginning of the article, the April 2015 futures contract had a return of -0.83%, while a direct investment in gold returned -2.23%.

That is a 1.4% boost in under two months!

However, it is somewhat complex to directly trade futures contracts, since they are typically quite large and you need to understand how to manage them. Luckily, there is an ETF called the PowerShares DB Gold Fund (DGL) that trades them for you. Instead of trading a futures contract yourself, you can just check the current holdings of DGL and then trade that instead.

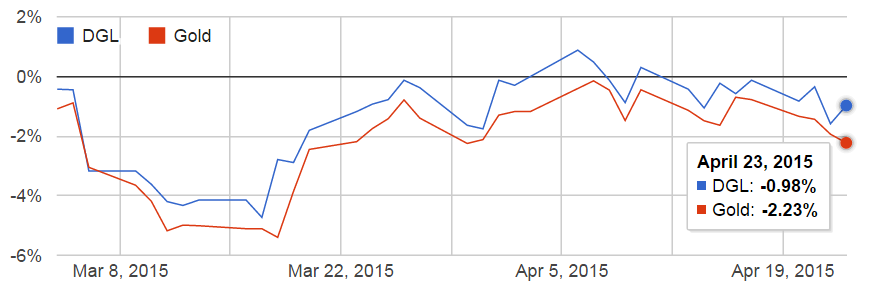

Performance of DGL vs. Gold Spot Price, March-April 2015

While DGL didn't perform quite as well as the direct futures contract, it was within 0.2%. Note that DGL does have an annual expense ratio of 0.78%.

Even if you use DGL, though, there are still two primary caveats to trading futures. First, you must plan on holding the underlying contract until its expiration date. This is because the futures market is quite volatile, and prices may move in either direction day-to-day. The futures price and the spot price are only likely to converge as the expiration date approaches.

If DGL currently holds the December 2015 contract, then, you would only want to buy that if you were planning to hold gold in your portfolio until that date.

Secondly, the final gain or loss on a futures contract will depend on your exact point of entry and sale. There is no guarantee you will be able to achieve the return expected based on the shape of the futures curve. Still, like any investment, it is simply a matter of trying to make the best bet.

Daily Monitoring of the Gold Futures Curve

If this strategy sounds appealing to you, you can see our daily tracking of gold futures prices and DGL holdings here. This can give you a general sense of which investment is currently optimal, though be wary that the data is not real-time and is meant only as broad guidance.

If you are holding some gold in your portfolio as it is, this strategy may help you boost your return no matter which way prices head.

Disclosure

This information does not constitute investment advice or an offer to invest or to provide management services and is subject to correction, completion and amendment without notice. Hedgewise makes no warranties and is not responsible for your use of this information or for any errors or inaccuracies resulting from your use. Hedgewise may recommend some of the investments mentioned in this article for use in its clients' portfolios. Past performance is no indicator or guarantee of future results. Investing involves risk, including the risk of loss. All performance data shown prior to the inception of each Hedgewise framework (Risk Parity in October 2014, Momentum in November 2016) is based on a hypothetical model and there is no guarantee that such performance could have been achieved in a live portfolio, which would have been affected by material factors including market liquidity, bid-ask spreads, intraday price fluctuations, instrument availability, and interest rates. Model performance data is based on publicly available index or asset price information and all dividend or coupon payments are included and assumed to be reinvested monthly. Hedgewise products have substantially different levels of volatility and exposure to separate risk factors, such as commodity prices and the use of leverage via derivatives, compared to traditional benchmarks like the S&P 500. Any comparisons to benchmarks are provided as a generic baseline for a long-term investment portfolio and do not suggest that Hedgewise products will exhibit similar characteristics. When live client data is shown, it includes all fees, commissions, and other expenses incurred during management. Only performance figures from the earliest live client accounts available or from a composite average of all client accounts are used. Other accounts managed by Hedgewise will have performed slightly differently than the numbers shown for a variety of reasons, though all accounts are managed according to the same underlying strategy model. Hedgewise relies on sophisticated algorithms which present technological risk, including data availability, system uptime and speed, coding errors, and reliance on third party vendors.