Summary

- Despite a 9% drop in equities last month, the Hedgewise strategy lost only 2.2% to 3.5%, depending on your Target risk level.

- By spreading investments across many asset classes and continuously adjusting for risk, the Hedgewise portfolio is far less susceptible to the radical swings of the stock market.

- Still, it has been an extremely challenging year, with every major asset class off 5% or more. While this is difficult in the short-term, odds are that this will look like a great buying opportunity in the long-run.

- Current conditions are likely being driven, at least in part, by fearful investor psychology. We examine similar historical environments to show why these circumstances often lead to positive outcomes using the Hedgewise approach.

Introduction

August was a rollercoaster ride for just about everyone. In our last newsletter, we noted that the commodity markets were signaling a major global event, which either meant that US equities were quite overvalued or that investors were badly overreacting to events in China. Soon after we published, it became impossible for US markets to ignore the real trouble brewing in the global economy.

As the month unfolded, it became clearer that commodity prices were no aberration, with many major export-heavy economies dipping into recession due to weak global demand. Strangely, though, the bond market remained quite out-of-sync. In typical environments, bonds will tend to rally on economic weakness, since both real interest rates and expected inflation will fall. Last month, though, bonds were also off about 1.5%.

This continues a theme that has occurred throughout this year - investors are getting more nervous about everything. The bond market is still pricing in a Fed rate hike this month, even while stocks are predicting a significantly weaker economic outlook. The Fed would probably only raise rates if there is significant inflationary pressure on the economy, yet the core drivers of inflation - oil, base metals, food - have all been rapidly falling in price.

This can be quite frustrating given the Hedgewise strategy is predicated on different assets moving in different directions. What does it mean when they all move down together?

When usual market patterns fail to manifest, there's a good chance that general fear is the culprit. Investors are nervous across the board, and beginning to price more risk into all markets at once. The bad news is that there is nowhere to hide in such conditions - everyone is losing money. The good news, though, is that this means at least one asset class is becoming significantly undervalued, which will inevitably become a boon for your portfolio when market conditions sort themselves out.

Even better, the Hedgewise strategy dynamically manages these kinds of environments for you, which is one of the reasons we outperformed the equity markets last month. When fear is increasing, we reduce investment exposure automatically, and thus decrease the likelihood of experiencing a significant loss.

With these factors in mind, it is actually a great time to stay invested. Historically, periods of irrational investor fear are short-lived, and quite frequently lead to outsized returns over the next year. Even if recent volatility is predicting a larger equity correction, the Hedgewise approach continues to provide far greater protection for your portfolio than the traditional mix.

Below, we further explain our August and YTD performance, and take a look at why history is heavily in our favor moving forward.

Understanding August and YTD Performance

Stocks experienced a number of significant dips over the course of the month, and were off over 10% at one point. Bonds were the most likely beneficiary of the global turmoil, since investors typically flock to them for safety, but that was not the case last month. Clearly, fixed income investors remain worried that the Fed will raise rates in September and potentially again by the end of the year. If the global slowdown continues, though, there is little chance this happens.

Despite the lack of a bond rally, the Hedgewise portfolio significantly limited losses compared to equities, losing less than half as much even at the Target 10% risk level. This is a natural outcome of diversification, which ensures that you are never fully exposed to a crash in a single market.

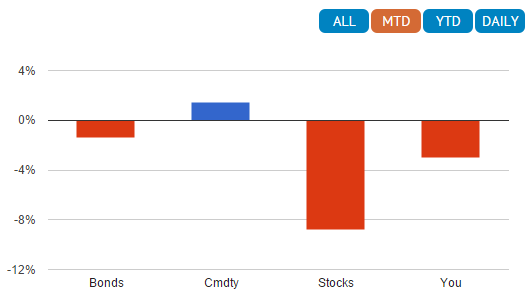

August Performance by Asset Class Compared to Hedgewise Target 10% Portfolio

In addition, recent losses have been mitigated because Hedgewise dynamically monitors risk, and reduces exposure to any assets that are "flashing red". This year, risk has continued to increase across the board, resulting in a lower overall exposure in every one of our portfolios.

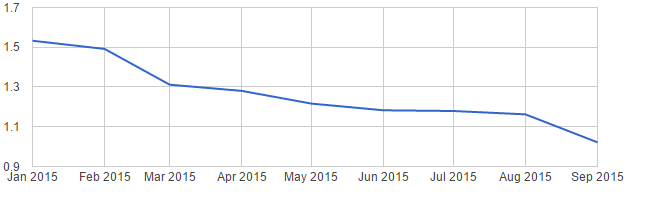

The following chart shows the model "leverage ratio" for a sample Target 10% portfolio over the course of this year, where a ratio of 1.5 : 1 means that you have $150,000 of investment exposure for every $100,000 in assets. Our overall exposure in September is about 33% lower than at the beginning of this year, which also means that August losses were similarly less than they might have been otherwise.

Target 10% Leverage Ratio, Model Portfolio, January 2015 to Present

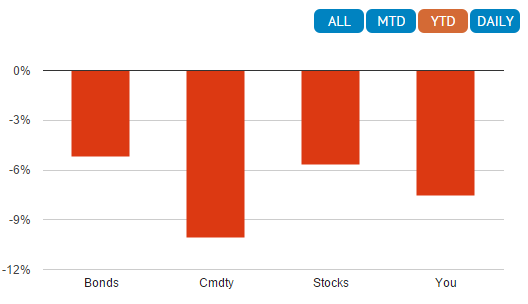

Though August was certainly encouraging in showing the power of our strategy's underlying concepts, it did little to improve our year-to-date performance, as every asset class is now off 5% or more.

2015 Performance by Asset Class Compared to Hedgewise Target 10%

Unfortunately, there has been nowhere to find safety this year. When investors are selling across the board, it typically indicates that fear is a core driver. The nice part about fear is that it is purely investor psychology, which has little to do with economic fundamentals. As a result, many assets get cheap at once, even though the underlying drivers haven't significantly changed.

While these conditions are challenging, history has shown that this is often a great time to buy, especially in a risk balanced portfolio.

Historical Perspective on Market Fear

Historically, a 60% bond / 30% stock / 10% gold portfolio has been a wonderful proxy for the risk parity approach, as we studied in-depth here. While this is significantly more simplistic than the live Hedgewise portfolio, it still presents a great proxy for identifying periods when different asset classes all lost money at once. Note that this portfolio is hypothetical only and based on index price levels of the S&P 500, 20yr nominal Treasury bonds, and gold. It includes all dividends reinvested but does not include any costs or fees.

We took a look at every 6 month period where the 60/30/10 portfolio lost 4% or more, which is fairly close to our current environment. This has only happened 21 times since 1970. Out of those 21 times, the portfolio achieved a positive return in 20 of the following years. Even more striking, the average return in the following year was 15.9%.

Upon reflection this isn't too surprising, if you agree that cheaper assets generally represent better deals. Still, it is no guarantee, especially in the very near-term. Heightened market fear is often an overreaction, but it can also be a predictor of a more significant crash. In both cases, though, a balanced portfolio remains a great bet.

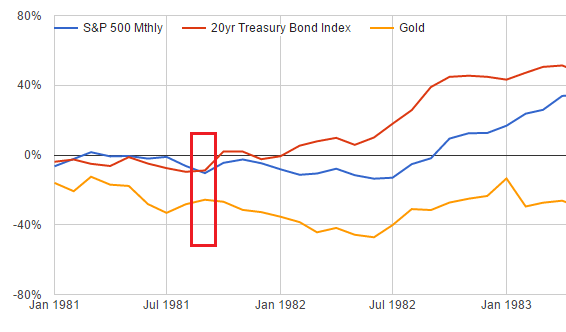

Case 1: Overreaction in September 1981

In late 1981, the US was just exiting a period of massive stagflation. Yet, it was unclear if the inflationary pressures had truly abated, and if not, it would spell more trouble for both stocks and bonds. By September, every asset class was in a correction, with the possibility of a weak economy and higher interest rates looming.

Performance of Various Asset Classes, 1981 to 1983

In retrospect, the collapse in gold prices didn't make much sense in this context, since gold generally rallies when inflation expectations are high. As it became clear that the country was past the worst of it, bonds began a huge bull market, and stocks followed over the next year.

The 60/30/10 portfolio did quite well after the lows were hit, because gold was near its bottom, while both stocks and especially bonds had significant upside. This is typical of a fear overreaction, as all assets get cheaper, but at least one really should be outperforming given the context.

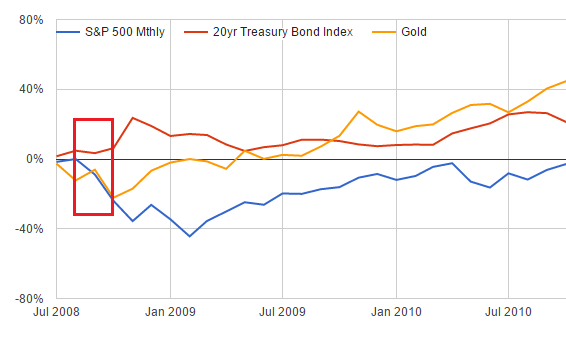

Case 2: Recession of 2008

In our second case, we'll look at a more familiar worst case scenario. In 2008, markets began to collapse in September after the Lehman bankruptcy. By October, stocks were already off 25% but bonds were strangely flat. Paranoia in the marketplace was pushing down the price of US Treasuries on fears of a full government collapse, as crazy as that might sound now. The US dollar had also spiked as the rest of the world scrambled for safety, deflating the price of gold and other commodities.

Performance of Various Asset Classes, 2008 to 2010

Now, the prospect of the US government defaulting on its debt seems rather outlandish, but we may also look back 5 years from now and think the same about the prospect of the Fed rapidly raising rates this year. As it became clear we were entering into a recession, but that the world wasn't otherwise falling apart, both gold and Treasuries rallied, helping keep the 60/30/10 portfolio relatively flat even during the worst crisis in the past twenty years.

This second case is particularly important because it highlights the power of diversification even in the darkest times. While there may be a few months in which many assets lose value together, a properly hedged portfolio still has a very high chance of retaining most of its value as markets return to balance. Even if you believed that we were heading for another 2008 this year, we are already using a strategy that is greatly equipped for it. On the other hand, if current market fears are overblown, then all assets may be due for a rally.

Wrapping Up

While the losses of this year are understandably difficult, there is great reason to believe they will be short-lived. Broad-based fears in the marketplace have led to an environment where every major asset class has lost 5% or more, but such fears generally lead to positive outcomes over the subsequent year. Even if there is greater market turmoil to come, the Hedgewise approach has shown a great resiliency to endure.

Months like August are stark reminders of the danger of an equity-heavy approach, and it appears likely that volatility will continue over the next 12-18 months. While this might lead to second-guessing in a traditional portfolio mix, there is no need to time the markets when using a risk parity approach. Our August performance helped illustrate how we limit losses during isolated corrections, and history has consistently rewarded portfolio balance - so long as you continue to trust it.

Disclosure

This information does not constitute investment advice or an offer to invest or to provide management services and is subject to correction, completion and amendment without notice. Hedgewise makes no warranties and is not responsible for your use of this information or for any errors or inaccuracies resulting from your use. Hedgewise may recommend some of the investments mentioned in this article for use in its clients' portfolios. Past performance is no indicator or guarantee of future results. Investing involves risk, including the risk of loss. All performance data shown prior to the inception of each Hedgewise framework (Risk Parity in October 2014, Momentum in November 2016) is based on a hypothetical model and there is no guarantee that such performance could have been achieved in a live portfolio, which would have been affected by material factors including market liquidity, bid-ask spreads, intraday price fluctuations, instrument availability, and interest rates. Model performance data is based on publicly available index or asset price information and all dividend or coupon payments are included and assumed to be reinvested monthly. Hedgewise products have substantially different levels of volatility and exposure to separate risk factors, such as commodity prices and the use of leverage via derivatives, compared to traditional benchmarks like the S&P 500. Any comparisons to benchmarks are provided as a generic baseline for a long-term investment portfolio and do not suggest that Hedgewise products will exhibit similar characteristics. When live client data is shown, it includes all fees, commissions, and other expenses incurred during management. Only performance figures from the earliest live client accounts available or from a composite average of all client accounts are used. Other accounts managed by Hedgewise will have performed slightly differently than the numbers shown for a variety of reasons, though all accounts are managed according to the same underlying strategy model. Hedgewise relies on sophisticated algorithms which present technological risk, including data availability, system uptime and speed, coding errors, and reliance on third party vendors.