Summary

- Hedgewise Risk Parity prioritized stability and returned 3% across most risk levels last year. Maximum drawdowns were less than half those in the S&P 500, and Hedgewise has a systematically brighter outlook than most passive strategies heading into 2021.

- The Fed has made real interest rates negative and effectively transferred profits from the future to the present. Any money made today is lost from tomorrow, which manufactures a de facto "bubble", encourages excessive speculation, and leaves investors with few realistic options.

- Hedgewise purposefully foregoes these kinds of short-term gains to ensure that long-term expectations remain positive and stable. Performance data firmly validates that this approach has driven higher risk-adjusted returns over time, even after a year where it "skipped" historically significant price inflation.

- Moving forward, Risk Parity is uniquely positioned to capture gains regardless of whether bubbles pop, rates rise, inflation spikes, or yet another unforeseen economic shock appears.

Introduction: Zero Interest Rates Are Not Free

As I covered in the last newsletter, the Fed's actions in 2020 represent a bigger economic story than the pandemic itself. It has dropped interest rates further and faster than any other time in history, and promised to keep them down indefinitely. As a result, real interest rates are now deeply negative, meaning investors are paying money to own government bonds, and this has had dramatic ripple effects across the entire investment universe.

In the last piece, my focus was on the broad mechanics of this on the economy, and how it would effectively increase prices, decrease return expectations, and amplify risk across all asset classes. The trouble is that on its face, this message seems similar to whenever the Fed has lowered interest rates, but that's not quite right. We've entered a degree of extremity that is very new, and that is unlikely to follow historical precedents in what happens next.

For a variety of reasons, the Fed threw "everything it had" at the pandemic last year. The scope of its intervention dwarfed anything that came before, and it has also brought the Fed about as far as it can go. If true, interest rates have finally reached a bottom after 30 years of churning ever lower. This creates two novel dynamics: the Fed has little ability to raise bond prices any higher, and current price levels are extraordinarily inflated. This is the end game of an economy over-reliant on the Fed for support, and it comes with a steep cost.

The logical result is asset bubbles with a number of odd properties. Unlike 'normal' bubbles, the Fed literally props these up, and they can persist despite outside investors being fully aware of the circumstances (e.g., the Fed can print money and buy bonds at a certain interest level even if no one else will). Ironically, this anchoring effect enables an inevitable "everything bubble" that is amplified by cascading ripple effects. Interest rates near zero justify explosively high multiples in riskier assets, and the difficulty in establishing an objective "fair price" encourages speculation and irresponsible risk taking. Phenomenal amounts of liquidity injected into the financial system as part of the Fed's mechanical process serve as the perfect enabler to allow this to spiral further.

Investors face an impossible choice. Most assets are already pulling future profits into today's price (because of zero interest rates), so there is no compelling passive option. Meanwhile, the riskiest investments rapidly appreciate due to speculative fervor. Despite increasingly negative long-term implications, there can appear to be no alternative to joining the speculation and hoping you can get out before it breaks.

The glue holding this unstable situation together is the belief that the Fed is in control, and it will not come undone so long as it remains that way. If there is even a tiny inkling that it may lose that grip - any kind of inflation scare would probably be sufficient - the bubbles will lose support. Even if the Fed vows to keep rates at these levels forever, you'd still be vulnerable to any other kind of economic shock, after which the Fed would have little ammunition remaining to buffer the impact.

Fortunately, Hedgewise provides another choice that can still function like a passive investment is supposed to. It has a positive long-term return expectation because it has alternative paths to gains, including commodity exposure and volatility management, and it explicitly minimizes exposure to assets as they become speculative. The trade-off is that you forego some gains along the way, but performance data demonstrates that this is consistently the right move, including in 2020.

Understanding the Fed Bubble Debate

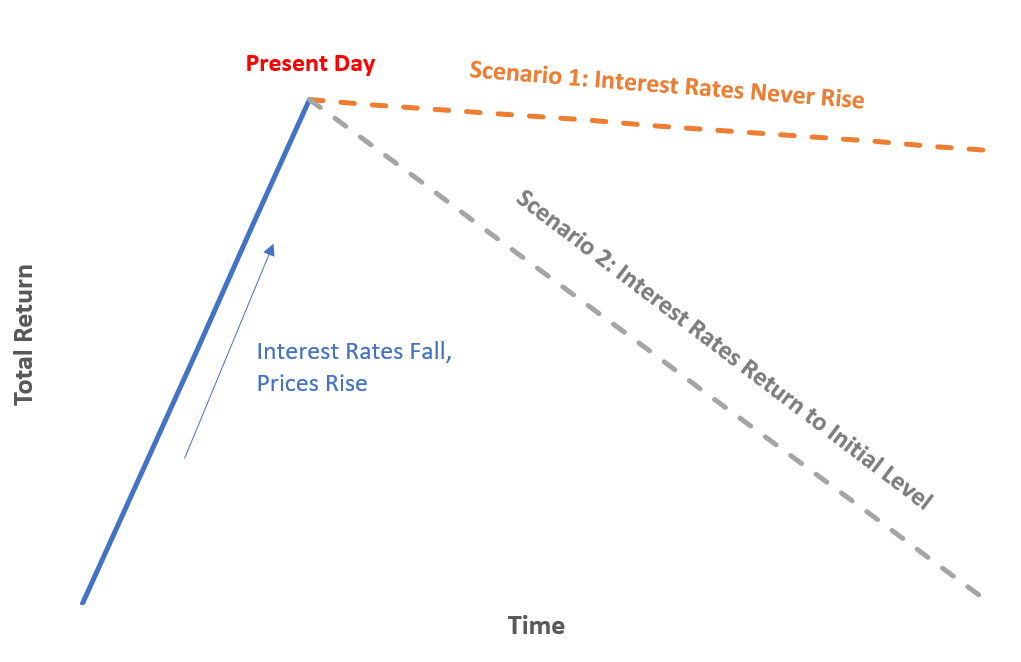

Fed bubbles are tricky because lower interest rates logically inflate prices. If interest rates never rise back up, you could argue that it isn't necessarily a bubble. Mechanically, this is simplest to understand via the Treasury bond market, which now faces a dilemma conceptually like the following graph.

Present Environment of Treasury Bonds

The situation in our present day is historically unique because real yields are negative, and the Fed exhausted its arsenal last year in response to the pandemic. All available future profit has already been pulled into today. The question for thought is whether this picture represents a "bubble".

Consider that you can only lose money from a passive investment in this asset, and that there is no compensation for significant downside risk. While it may not be based in speculation or irrationality because the Fed is controlling it, it's a terrible deal by any other name.

Investors allow this to persist because the Fed can directly control bond prices via money printing, and because a similar dynamic simultaneously applies to most other kinds of investments. In other words, there is no perceived alternative to taking the bad deal.

The "Everything Bubble"

The link between bond prices and interest rates is definitional, but most other asset classes will be similarly affected. This is because you have to decide how to discount future cash flows for an investment in anything; if you discount them by 1% instead of 5%, you get a much higher present fair value. This is always true, but in the same vein as Treasury bonds, we have gotten into uncharted territory with the Fed's actions during the pandemic.

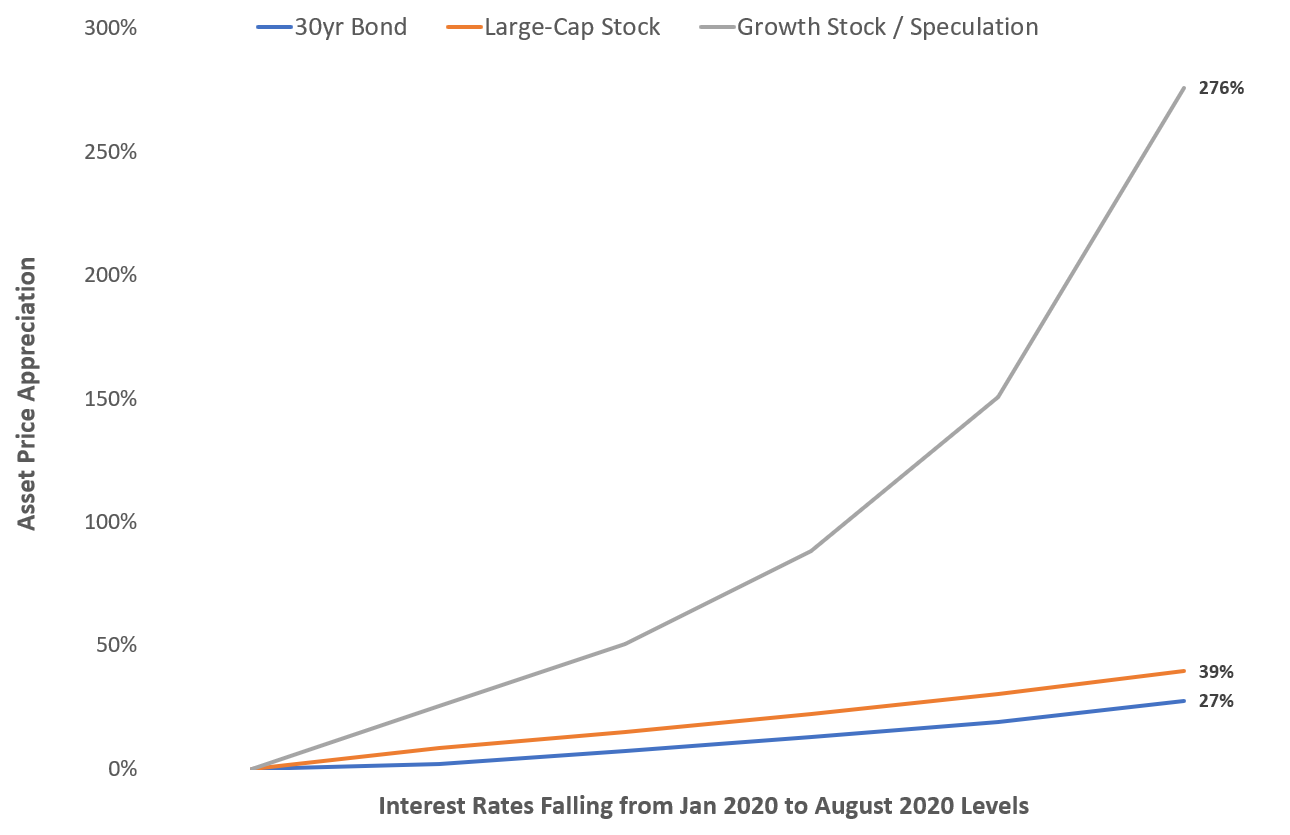

It's not possible to know precisely how much an impact it should have on an asset class like equities, but we can get to some basic estimates with a simple discounted cash flow model. The following chart models how three different types of investments might respond as interest rates fall from where they started 2020 to the lows reached over the summer. This assumes that there are no other changes to earnings, longer-term economic prospects, etc. - this is the impact of interest rate changes in isolation.

Interest Rate Model Impact on Prices in Bonds, Large-Cap Stocks, and Growth Stocks

The reason that growth stocks might appreciate so much faster is a mathematical quirk of fast earnings growth assumptions and low interest rates. In broad strokes, the idea is that a risky asset with a small chance of making a huge amount becomes much more valuable when returns are scarce elsewhere. It requires a degree of naivety to believe this is valid, especially at extreme price levels, but the broad point is that the case can still be made.

Though these numbers are merely "back of the envelope", the similarity to 2020 is notable. 30yr Treasury bonds returned 29.53% from January through August; the S&P 500 returned 43.89% from April through August; Tesla was up 393.23% from April through August.

To emphasize, these gains do not come from any actual changes in total profit. If interest rates stay where they are, you face expected future returns that are lower by an equivalent amount spread over time; if interest rates go back up, you expect to incur identical short-term losses as the situation reverts. It's many different versions of the same bad deal: most assets get unreasonably expensive and face increasing downside risk in cascading degrees.

The wild part of all of this is that as the deal gets worse and worse in terms of the future, you make more and more money today. How is a rational investor supposed to approach this?

The FOMO (Fear of Missing Out) Effect

The basic problem is that no rational investor wants to miss out on profit. Consider this example: today is day zero, and somehow you know for sure that equities are going to yield no greater than 3% a year with a 50% downside risk over the next decade. Is that a compelling investment?

Next, imagine a slight wrinkle. Equities keep the same total return/risk profile, but this time you know equities will gain 30% over the next twelve months. After that, they will yield no greater than 0% a year with an 80% downside risk over the remaining nine years. What's the right approach?

It will be extremely difficult for an investor to forego the 30% gain, despite the fact that this is otherwise a poor investment. Thus, many will pile in on the way up, fearing to sell before the peak and miss this last bit of upside.

This pattern is further amplified in riskier, more illiquid segments of the market where outsized returns are perceived as more likely. Ironically, as an asset price becomes increasingly disconnected from economic reality, it becomes easier to believe that it may be justified as others appear to buy at yet higher prices.

With few compelling opportunities elsewhere, and a broad sentiment that maybe low interest rates make all of this reasonable, this kind of speculative fervor can easily turn the "Fed bubble" into a much more garden variety one. There is little doubt that this is now happening in many fringes of the market, including in penny stocks, cryptocurrencies, and SPACs at a minimum.

The psychology in play is similar to most bubbles in history, but our current conditions provide a uniquely fertile ground for this to happen. There is more cash than ever floating around the system due to a combination of massive fiscal stimulus, direct asset purchases by the Fed, and delayed spending due to the pandemic (trips, entertainment, etc.) The normal "safe" options to park that cash are gone because the Fed has put the same "bad deal" in place across the board. If everything is in a bubble anyway, what option do you have but to buy in?

This is a false choice. Proper risk management is built with just these kinds of situations in mind. It allows you to lean away from risk, rather than into it, without sacrificing long-term gains. It sidesteps the bad deals and the speculation, and focuses on a more stable return stream. These techniques continued to work as expected last year, and create a systematically more positive outlook than most investors face moving forward.

Another Option: Evaluating Hedgewise Risk Parity in 2020

Let's briefly return to the basics of the bond market. For the 2020 calendar year, long-term bonds gained 22.5%, but this also introduced negative real interest rates and the bleak future prospects discussed earlier. Hedgewise missed out on most of that gain on purpose, and as a result, returns were 10-15% lower last year than they might have been (depending on risk level). There is also significant evidence that this was the right move.

Risk management is grounded in the idea that greater stability wins over the long run. It isn't worth chasing potential upside if it introduces future downside. By avoiding environments of excessive risk, you expect to eliminate both big gains and big losses, and you expect that to be a winning trade-off over time.

Last year presents a fascinating case study of this principle because bonds had such large annual returns, but achieved this is in the riskiest possible way (i.e., the Fed eliminated the possibility of future positive real returns). It should be little surprise that exposure to bonds was limited throughout. The question is whether this missed upside is mitigated by other periods of minimized downside.

Fortunately, this question is easy enough to answer, and we do not have to wait to see how the immediate future pans out. If the theory is working according to plan, the benefits of stability should accrue constantly over time, and demonstrate resilience even during a year like 2020. Data shows that this is exactly the case.

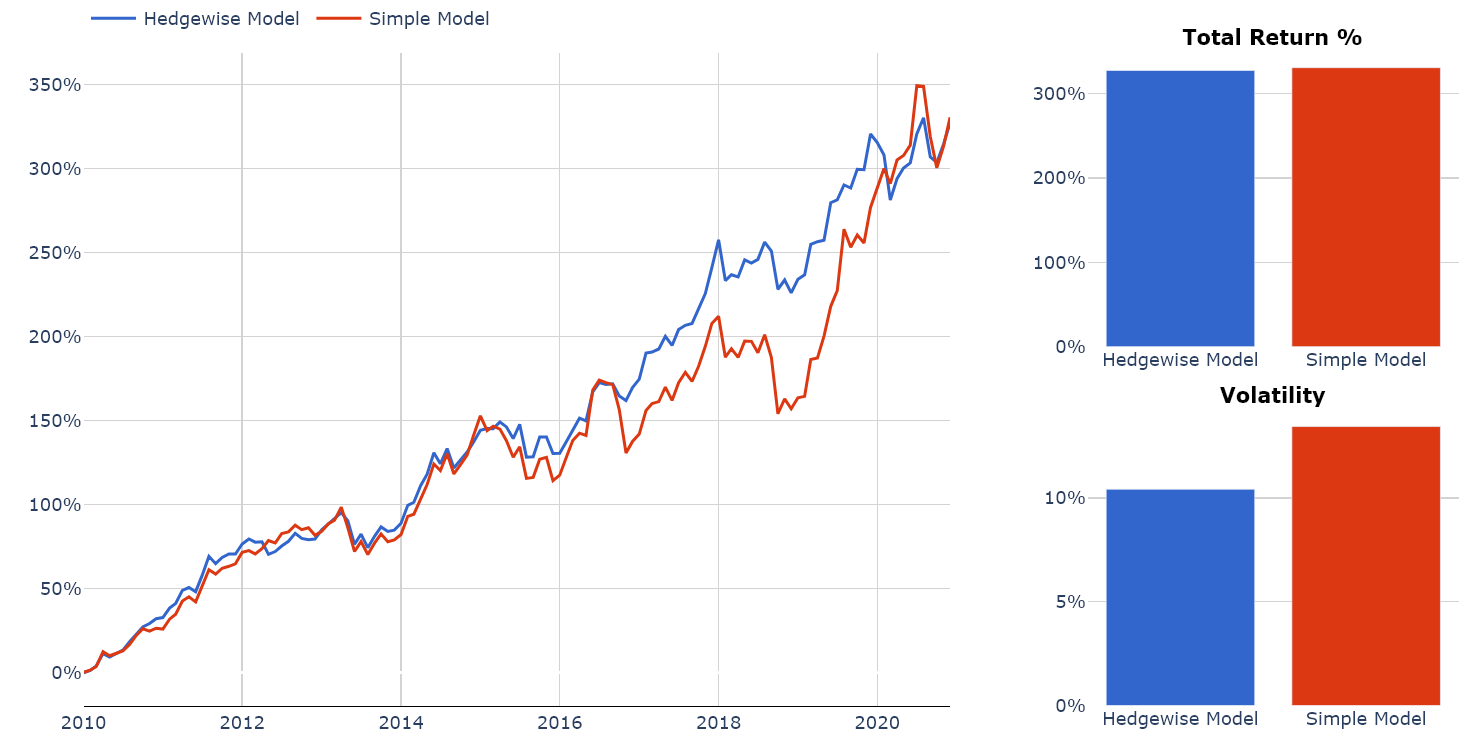

Here's a look at the performance of the normal Hedgewise risk model compared to a "simpler" one which does not account for the absolute level of interest rates (see more detail on the specific Hedgewise approach). For context, the simple model generally has 60%+ bond exposure at all times, while the normal model had less than 10% exposure for most of 2020.

Hedgewise vs. Simple Model Performance Since 2010

| Annual Return | Volatility | Sharpe | Max Loss | |

|---|---|---|---|---|

| Hedgewise Model | 14.11% | 10.42% | 1.35 | -10.66% |

| Simple Model | 14.19% | 13.44% | 1.06 | -18.57% |

Since 2010, the normal risk management algorithm has achieved nearly the same exact return with 30% less volatility and half of the maximum drawdown. Looking deeper into how that unfolded, notice how the simple model outperformed dramatically from 2019 onward, but that only served to make up for its underperformance for three years prior. These periods are two sides of the same coin; you can't have one without the other. In some periods of heightened risk, it limits losses, while in others it misses gains. Over time, the benefits should outweigh the costs, and it's clear that they have.

This is especially impressive considering that bonds likely reached their peak possible price last year. The strategy has foregone as much short-term performance as it likely ever will, and the results still hold up at this moment in time. Meanwhile, the "simple" model is now facing its darkest ever outlook. You can already begin to see this unwind as interest rates have started creeping back up since their lows last August.

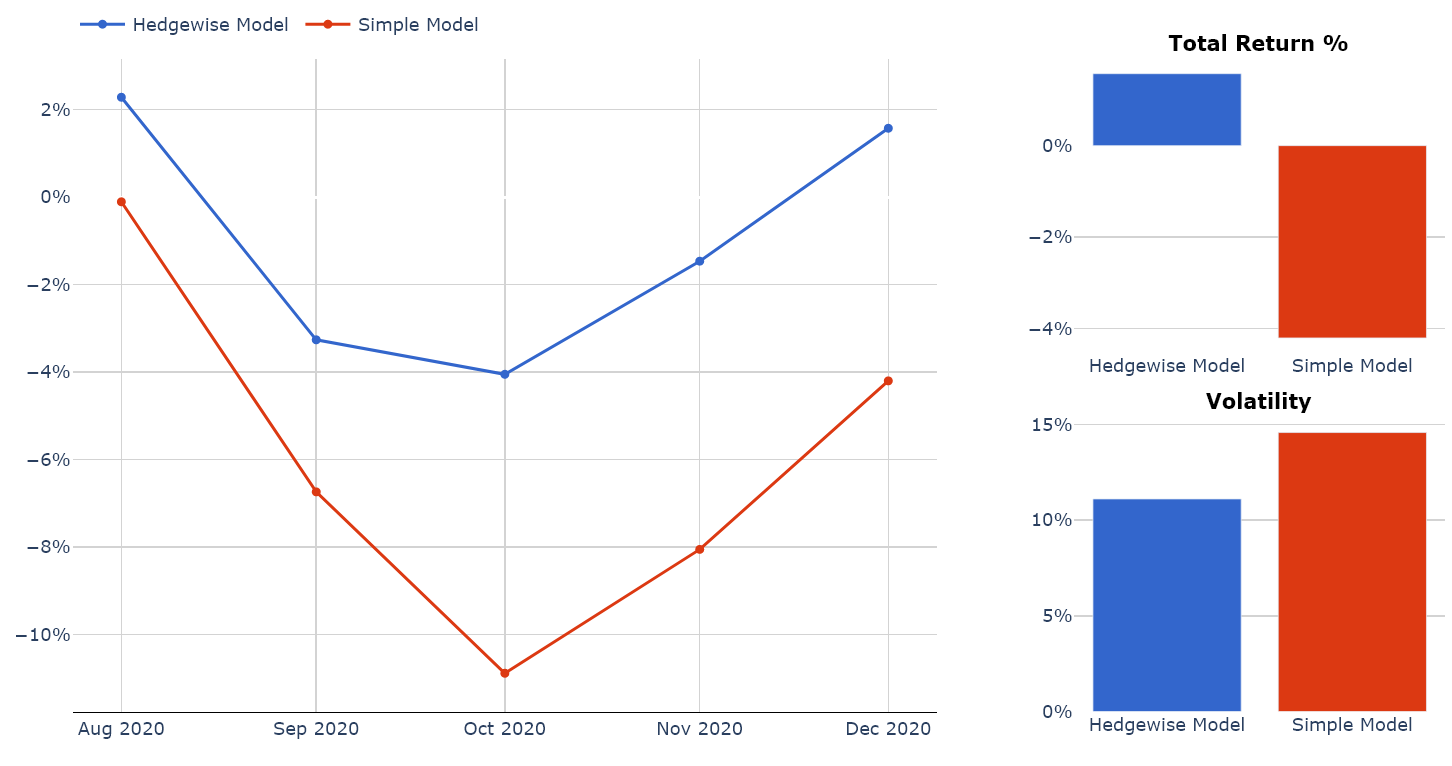

Hedgewise vs. Simple Model Performance, August 2020 through January 1, 2021

Every outcome being studied here is not surprising from a financial theory perspective: this is all how it is supposed to work. The challenge is reconciling short-term intuition about what is happening. You do not want an extra 10-15% gain last year in the form that it came; if you had taken it, you would have already lost more than it was worth in the years prior, and now you'd be stuck with a terrible future outlook. Proper risk management is constantly positioned for systematically better performance, but it will be the easiest to second-guess at the height of a speculative frenzy. Ironically, that is also the precise moment when it is more valuable than ever.

Looking Forward: How to Make Money in 2021

Looking ahead, I'd advise extreme caution with any investments that appreciated 100% or more last year, especially where that was not accompanied by an actual increase in revenue or profit. It's too hard to explain any reasonable path back to economic reality, and you face a double risk of excessive speculation alongside a reversion of interest rates, either of which could result in double-digit losses.

Passive fixed income remains a poor choice because any kind of bond, whether corporate or government, is tethered to the negative real interest rates being driven by the Fed. However, there is the potential for volatility-driven gains, especially as interest-rate uncertainty rises. This is the approach which Hedgewise implements and has been discussed at length previously.

The outlook for the S&P 500 is a little trickier. Most large-cap equities have not been subject to as much of a speculative surge as smaller growth companies, but prices are likely inflated by 20-30% due to interest rates, and that will be a headwind if there is any inflationary pressure. If interest rates stay put for a long while, you might still eke out a 4-6% annual gain, but that assumes there are no other negative economic shocks in the interim (stagflation, war, climate change, higher taxes, systemic inequality, among others). The Fed has little ammunition left to support the economy against anything else. It's not a great risk/reward proposition, so I'd tread cautiously and would sooner wrap this exposure into a risk-managed approach than leave it outright.

Commodities are a rare bright spot that have little connection to interest rates while providing an excellent hedge against any inflationary surprises. These prices are determined mostly by supply and demand, so gains and losses generally reflect real changes in economic activity rather than speculation. If we do have a robust bounce back from the pandemic, industrial commodities and energy should do quite well even if interest rates bounce back up.

For most traditional investors, this leaves a barren landscape, and many feel forced to take on excessive risk or speculate. Against this, Hedgewise is uniquely positioned to provide an alternative, as it is built to systematically manage interest rate risk, includes balanced commodity exposure, and is not overly reliant on equities to drive returns.

Speculative environments are always challenging to navigate, and this is especially true during one anchored by the Fed. That doesn't change the basic facts: excessively high prices are bad for future returns, and this applies even if the high prices are everywhere. Hedgewise has an approach to manage this risk that has been effective for decades, and it will likely be even more valuable given the conditions facing the market after 2020.

Disclosure

This information does not constitute investment advice or an offer to invest or to provide management services and is subject to correction, completion and amendment without notice. Hedgewise makes no warranties and is not responsible for your use of this information or for any errors or inaccuracies resulting from your use. Hedgewise may recommend some of the investments mentioned in this article for use in its clients' portfolios. Past performance is no indicator or guarantee of future results. Investing involves risk, including the risk of loss. All performance data shown prior to the inception of each Hedgewise framework (Risk Parity in October 2014, Momentum in November 2016) is based on a hypothetical model and there is no guarantee that such performance could have been achieved in a live portfolio, which would have been affected by material factors including market liquidity, bid-ask spreads, intraday price fluctuations, instrument availability, and interest rates. Model performance data is based on publicly available index or asset price information and all dividend or coupon payments are included and assumed to be reinvested monthly. Hedgewise products have substantially different levels of volatility and exposure to separate risk factors, such as commodity prices and the use of leverage via derivatives, compared to traditional benchmarks like the S&P 500. Any comparisons to benchmarks are provided as a generic baseline for a long-term investment portfolio and do not suggest that Hedgewise products will exhibit similar characteristics. When live client data is shown, it includes all fees, commissions, and other expenses incurred during management. Only performance figures from the earliest live client accounts available or from a composite average of all client accounts are used. Other accounts managed by Hedgewise will have performed slightly differently than the numbers shown for a variety of reasons, though all accounts are managed according to the same underlying strategy model. Hedgewise relies on sophisticated algorithms which present technological risk, including data availability, system uptime and speed, coding errors, and reliance on third party vendors.