Summary

- Commodities have officially entered a bear market, as oil and precious metal prices are at decade lows. This is being driven by a slowdown in China and the surging US dollar.

- At these levels, commodities are either a tremendous value or a harbinger of coming trouble for the economy. Either way, a hedged portfolio remains the best bet.

- The Hedgewise strategy has continued to limit losses despite this crash, demonstrating its resilience against bear markets no matter where they occur.

- Remember that all assets tend to appreciate over time, and that downturns present an opportunity to buy low and sell high. We discuss how rebalancing across asset classes turns bear markets into boons for your portfolio over the long-run.

The Commodity Firesale

A surprising string of events has driven commodity prices down to levels not seen since 2005. After adjusting for inflation, commodities have actually gotten cheaper over the past decade. This probably means one of two things: either real assets are now an incredible bargain, or a global recession is brewing and the stock market just has not noticed yet. Luckily, the risk parity framework accounts for either scenario and continues to protect your portfolio regardless.

First, let's take a look at the strange conditions that have decimated real assets over the past month. China is the world's biggest consumer of commodities like oil and copper, but its stock market has lost 30% in the last month on concerns of significantly slowing growth. Commodity prices began to fall as a result, and had an instant ripple effect on the economies of export-heavy countries like Australia and Brazil. This, in turn, is suggesting lower global growth as a whole, further perpetuating the bad news.

Meanwhile, the US has had mostly "okay" news over the summer compared to the rest of the world. The job market is back to pretty good shape, and while corporate earnings haven't been great, they haven't been terrible either. Compared to the Greek crisis and the China collapse, "just okay" has somehow become "the best in the world".

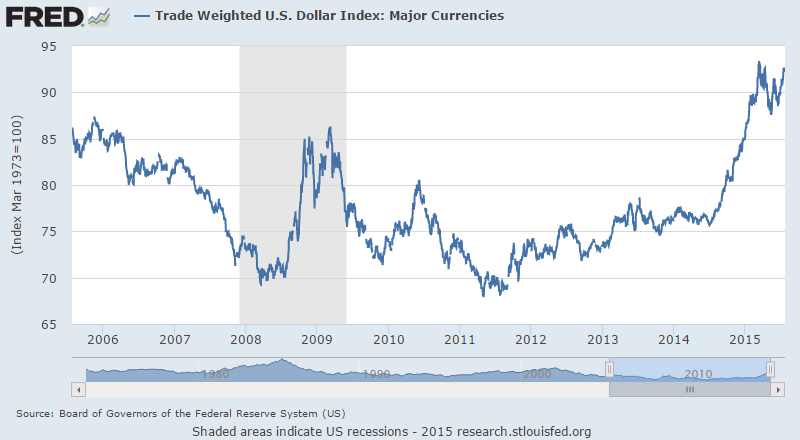

Thus, demand for the US dollar has skyrocketed. It is up over 20% this year and at its highest level of the decade. Since commodities are priced in dollars, a stronger greenback makes them even cheaper still.

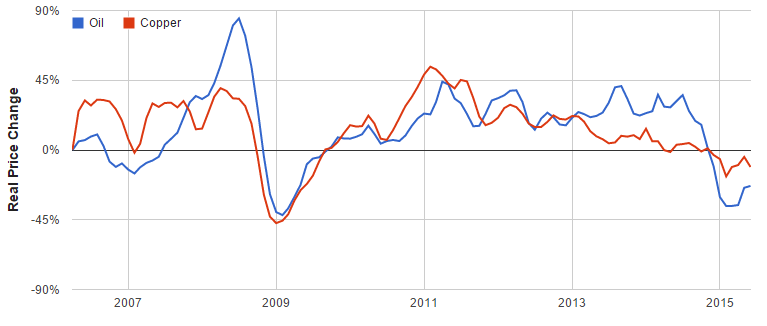

While this might sound pretty reasonable, a quick look at history shows that this has become a very extreme environment. Generally, real assets like oil and copper tend to keep up with inflation, since both assets are key components in so many different kinds of goods. At current levels, though, both assets are now less expensive in real terms than they were in 2006.

Change in the Real Price of Oil and Copper since 2006

The US dollar is in a similarly outlandish place. Compared to a basket of six other major currencies, the dollar is at its strongest level of the past decade. For reference, it is about 10% stronger than during the depths of the 2009 crisis, when the whole world was looking for safety. It is also stronger than 2006, when the US was in the midst of the housing boom.

US Dollar Index Since 2006

The Inherent Contradiction

The picture this creates is one in which the rest of the world is falling off a cliff while the US remains basically unaffected. The problem with this scenario is that global economics are unavoidably intertwined, and will eventually affect the US one way or another.

A stronger US dollar means that US products are now more expensive in the rest of the world, which will naturally decrease our exports and increase our imports. If much of the world is also at or near recession, this will even further decrease demand for US goods. Formulaically, this will cause US GDP to fall.

To combat this, the US would have to generate enough internal demand from consumer or government spending to compensate. Yet there is little to suggest this will be possible, with consumer spending growing at a tepid pace and the Fed close to raising rates for the first time in a decade.

If current commodity prices are any true indication of the severity of global conditions, the US economy will soon be affected and our stock market is almost certainly overvalued. The combination of a strong dollar and weakening global demand will simply be too great to overcome.

Of course, there is also the possibility that it's not so bad, and investors are just overreacting. China might have a soft landing, and the quantitative easing efforts in Europe could pay off. Commodities are also notoriously volatile, and these kinds of wild swings in either direction are often poor indicators of the underlying economics. In this case, commodities might be priced at a screaming bargain, as they often have been after similar downturns in the past.

Average Commodity Returns Following a Year of >20% Loss

| Avg 1yr Return | Min 1yr Return | Max 1yr Return | |

|---|---|---|---|

| Oil | 33% | -36% | 132% |

| Copper | 21% | -20% | 125% |

Of course, it is impossible to know which scenario will unfold, which is why Hedgewise always advises to avoid making bets one way or the other. Nor is it necessary when proper diversification and risk management put you in a position to benefit regardless.

How Hedgewise Fits In

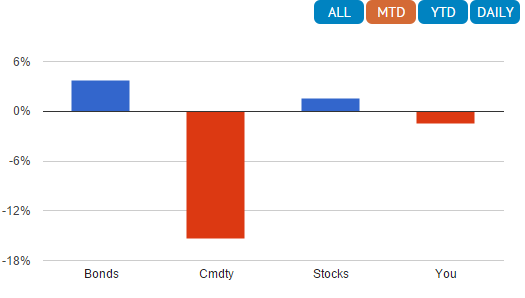

Even though most commodities lost over 15% last month, their effect on the Hedgewise strategy remains relatively muted. By dynamically measuring risk, Hedgewise reduces the chance that a crash in any market will significantly impact your portfolio. Since last summer, we've now experienced one major bond correction and two commodity crashes, yet our performance over this timeframe is near breakeven. In our book, that's a big win.

While it can be hard to recognize any kind of loss as a good thing, the goal of the risk parity framework is to limit your downside in bear markets so you can more fully participate in bull markets. Hedgewise invests more evenly across bonds, stocks, and commodities than traditional portfolios, which are typically quite stock-heavy. As a result, the traditional portfolio will tend to experience huge, infrequent losses during events like 2008, while the Hedgewise portfolio will experience smaller losses more often.

This model has proven quite effective over the long run for two reasons. First, smaller losses are superior by the simple math of investing. If you lose 40% of your portfolio value, you need to then gain 67% to get back to even (since you now have so much less capital). However, if you lose 10%, it only requires an 11% gain to recover.

Secondly, diversification across asset classes allows you to automatically "buy low" and "sell high". As one asset price falls, it naturally becomes a smaller portion of your portfolio. To maintain proper balance, it becomes necessary to buy more of that asset on the way down, while selling assets that have increased in price and thus become a larger portion of your portfolio. This allows you to quite methodically buy the bottoms and sell the tops, without having to time anything at all.

Looking at the live performance of one of our Target 10% clients last month, you can see that our losses are fairly insignificant compared to the size of the commodity crash.

July Performance, Target 10% Portfolio ("You") Versus Benchmarks

This portfolio still has most of its capital intact, as well as the opportunity to shift weight into an asset class that just got 15% cheaper. The bigger the fire sale, the more potential accrues. While you do have to tolerate the short-term loss, you are guaranteed to be collecting some great bargains along the way.

Compare this to a traditional mix, which has very little exposure to asset classes besides equities. While it may have made money this month, it is missing out on every sale and leaving all of its eggs in one very expensive basket. The higher it goes, the less opportunity there is for the future.

Conclusion

There is no mistaking that it has been a difficult stretch in the markets. Given the magnitude of the movements over the past year - two 40% drops in oil, a 15% drop in bonds, a 20% drop in all other commodities - the performance of the Hedgewise portfolio has been right in line with expectations (1% to 5% loss, depending on your risk level). The drawdown is relatively small compared to the steep losses in individual assets, and the portfolio is automatically rebalancing to take advantage of cheaper prices.

Current market conditions have been full of contradictions, and there could be a massive commodity turnaround or a sudden stock crash. Not to worry, though - it doesn't really matter which one happens so long as you remain steady. Every market cycle is just a new opportunity to sell high and buy low, and Hedgewise was built with just this in mind.

Disclosure

This information does not constitute investment advice or an offer to invest or to provide management services and is subject to correction, completion and amendment without notice. Hedgewise makes no warranties and is not responsible for your use of this information or for any errors or inaccuracies resulting from your use. Hedgewise may recommend some of the investments mentioned in this article for use in its clients' portfolios. Past performance is no indicator or guarantee of future results. Investing involves risk, including the risk of loss. All performance data shown prior to the inception of each Hedgewise framework (Risk Parity in October 2014, Momentum in November 2016) is based on a hypothetical model and there is no guarantee that such performance could have been achieved in a live portfolio, which would have been affected by material factors including market liquidity, bid-ask spreads, intraday price fluctuations, instrument availability, and interest rates. Model performance data is based on publicly available index or asset price information and all dividend or coupon payments are included and assumed to be reinvested monthly. Hedgewise products have substantially different levels of volatility and exposure to separate risk factors, such as commodity prices and the use of leverage via derivatives, compared to traditional benchmarks like the S&P 500. Any comparisons to benchmarks are provided as a generic baseline for a long-term investment portfolio and do not suggest that Hedgewise products will exhibit similar characteristics. When live client data is shown, it includes all fees, commissions, and other expenses incurred during management. Only performance figures from the earliest live client accounts available or from a composite average of all client accounts are used. Other accounts managed by Hedgewise will have performed slightly differently than the numbers shown for a variety of reasons, though all accounts are managed according to the same underlying strategy model. Hedgewise relies on sophisticated algorithms which present technological risk, including data availability, system uptime and speed, coding errors, and reliance on third party vendors.