Summary

- Hedgewise Risk Parity+ incurred less than half the drawdown of the S&P 500 in March, and current YTD performance ranges from -4% to +1%, depending on risk level

- The Covid pandemic provides a compelling, real-life case study of how the framework effectively withstands 'black swan' events and relieves clients from excessive worry and decision-making when it matters most

- Longer-term performance is equally impressive, as Risk Parity+ has matched the performance of the S&P 500 for the past 5 years with approximately half the risk (equivalent to a 2x risk-adjusted return)

- Hedgewise has also outperformed all major competitors by over 5% during the pandemic, and from 12-35% longer-term

- Risk Parity+ remains uniquely well-suited to handle the substantial uncertainty of our new virus-ridden, zero-interest, financially unstable world. The framework is fundamentally built to manage volatility, and to generate positive returns regardless of what comes next.

Silver Linings of a Terrible 2020

The Covid-19 pandemic marks the first time ever that an entirely external event has seriously threatened the integrity of the financial system, primarily due to the rare nature of the disease itself and the poor global health response. In my initial commentary in early March, I surmised that even if Covid wound up as bad as the Spanish Flu of 1918, it would still be temporary in nature, and justify no more than a 10-15% decline in equity prices. Fast forward to today, and stocks are down around 12% from their peak in February. Yet this belies the extraordinary chaos between then and now, which highlights threats to the theory of "rational markets" while demonstrating how Risk Parity calmly weathers the unprecedented. As we navigate a systemically precarious future, it is some small comfort to have an investment option built precisely for an uncertain world.

To briefly recap, Covid's mix of asymptomatic spread, extreme contagiousness, and highly variable death rate raises it to a similar severity as the Spanish Flu, at least economically speaking. Even so, the WHO had estimated the global cost of such an event at $3 trillion. As of last week, the latest estimates of the cost of Covid are $6 to $9 trillion. Why is this going so much more badly than expected?

Well, the WHO model assumes that governments and individuals will act rationally to contain the disease and minimize the need for draconian lockdowns. It isn't that complicated: you test, trace, and quarantine early and aggressively. The U.S. and many other wealthy countries have continued to fail at this task and it remains highly worrisome that we are now re-opening without much of an improved testing strategy. This failure raises the possibility that a fundamentally external natural disaster might turn into a permanent financial problem, which sets off a number of other financial dominos.

While central banks and federal governments managed to avert an independently fueled financial meltdown in March, it is highly concerning that this was even a possibility. Markets continue to display an inability to effectively price in the impact of the pandemic, which is deeply intertwined with the inability of the larger population to approach the health threat effectively. This is symptomatic of broad societal dysfunction: what should have been a large-scale, contained, temporary natural disaster has now morphed into a global recession.

Fortunately for Hedgewise Risk Parity clients, there has been no need to unravel the financial meaning of all of this. Clients are at or near breakeven YTD, regardless of risk level. In the depths of the March meltdown, drawdowns were also less than half those in equities. Beyond the numbers alone, this helped relieve clients from being thrust into decision-making under duress, while re-emphasizing why there is no need to time your investment with the Risk Parity approach.

Looking forward, there will be various levers for Risk Parity to accrue future gains, whether from volatile interest rates, recovering energy markets, or inflation hedges. Unfortunately, I'm not nearly as optimistic on the return of broader global stability - but that's why Hedgewise offers an investment strategy that doesn't rely on it.

Evaluating Performance During the Pandemic

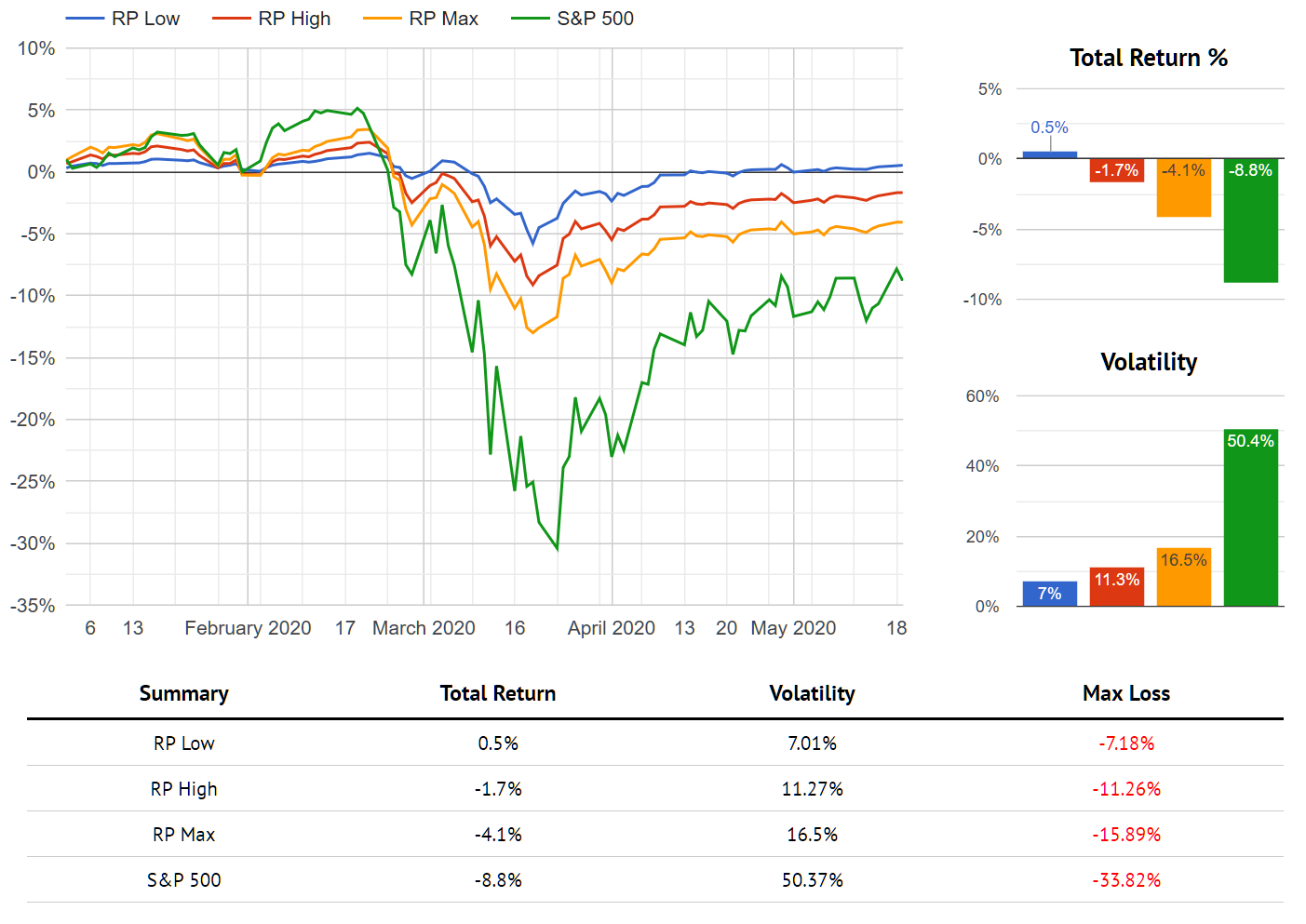

Here is a quick snapshot of Hedgewise Risk Parity+ performance thus far in 2020.

Hedgewise Risk Parity+ vs. S&P 500, 2020 YTD

While the end result remains impressive - every risk level continues to outperform the S&P 500 this year, despite the enormous equity recovery in April and May - the journey through March is far more important. Passive equity investors often point out crashes and subsequent recoveries as evidence that the buy-and-hold approach works just as it should. This point ignores two crucial aspects of any real crisis:

- There is always a possibility that this time is different, and stocks will fail to recover and suffer additional losses instead. In mid-March, the idea of a second Great Depression was a real and present danger.

- Passive investors are forced into the position of an active decision-maker as the above possibility becomes more likely.

Risk Parity is designed to mostly avoid this dilemma, but it often takes a crisis like the current one to understand why this is so valuable. This point isn't that traditional equity investing is a bad approach in an absolute sense, but rather that it involves a significant level of risk and decision-making that may be difficult to fully value until you are in the middle of a crisis. The ability to sidestep these situations provides a form of relief on many different levels, both financial and psychological. Even better, this relief is possible without sacrificing long-term returns, which Hedgewise can now demonstrate with years of live performance data.

The Longer-Term Picture

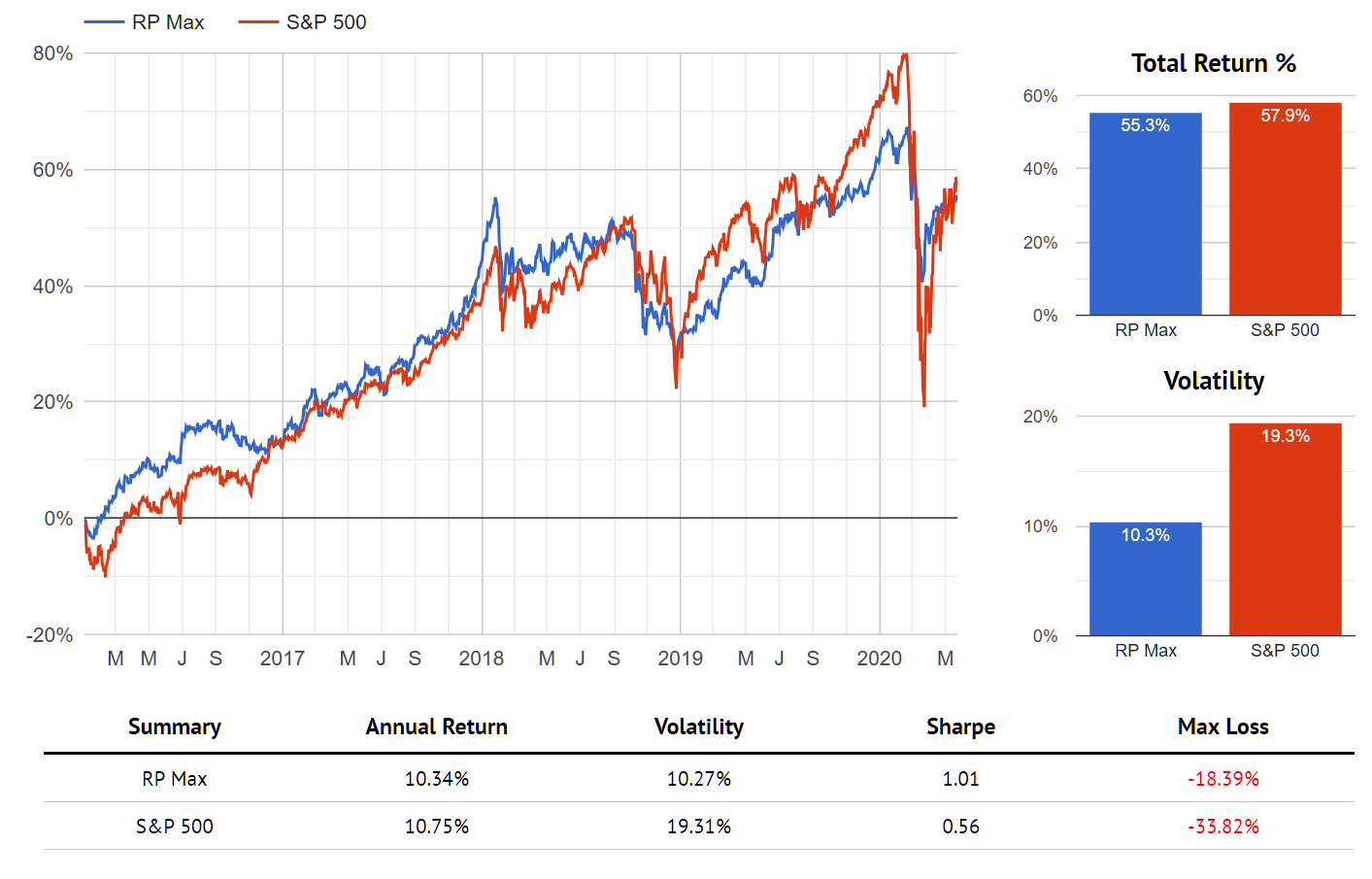

Hedgewise began running the current iteration of its risk management model in 2016. Let's take a look at how the Risk Parity+ Max product (which seeks a similar target return to equities) has performed since then.

Risk Parity+ Max vs. S&P 500 Since 2016

On first glance, both Risk Parity+ and the S&P 500 look reasonably similar, especially in terms of total return. The question becomes how to properly value the lower volatility and drawdown levels that Risk Parity+ offers. What is it worth to be able to avoid the need to predict the outcome of the pandemic? Or the Trump election? Or Brexit?

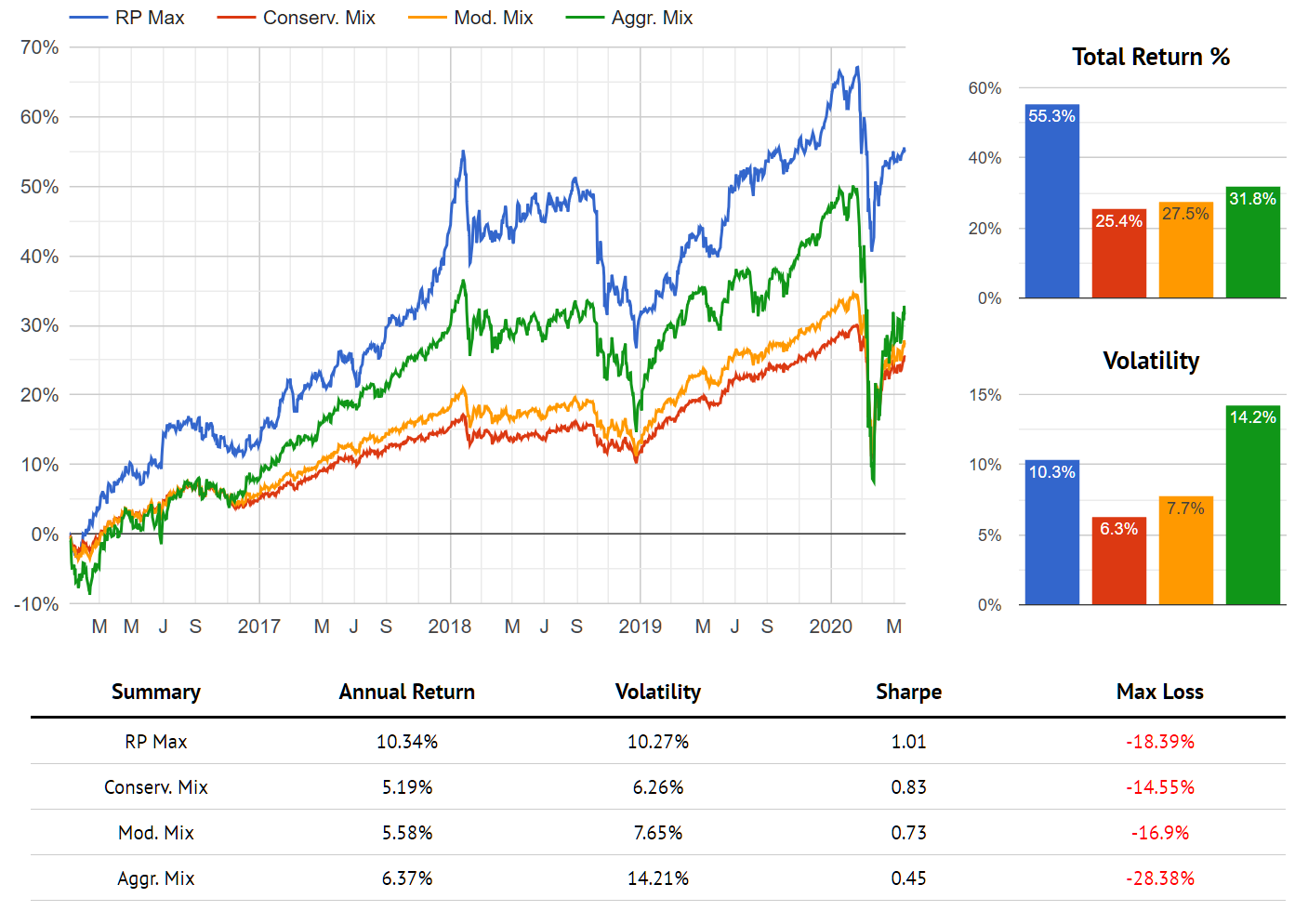

If it's not clear how to value these events, another way to frame this comparison is against more traditional diversified baskets of stocks and bonds, which have closer levels of volatility and drawdown to Risk Parity than the S&P 500.

Below I've compared the performance of three passive iShares ETFs - Conservative (AOK), Moderate (AOM), and Aggressive (AOA) - that are benchmarked to such traditional mixes.

Risk Parity Max vs. Traditional Passive Mix Benchmarks Since 2016

This paints a clearer picture of the benefit. The Hedgewise framework maintained a level of volatility and drawdown closest to a traditional "moderate" mix, yet more than doubled your total realized return.

While the financial theory driving this performance is conceptually simple, there are still many different methods of implementation. Fortunately, recent events have also provided evidence that the Hedgewise approach is uniquely effective.

A Better and Simpler Understanding of Risk

In previous articles, Hedgewise has shared many of the foundational risk management principles on which it relies, such as balancing assets based on macroeconomic environments, explicitly accounting for "bubbles" and tail risk, and uniquely accounting for specific asset classes (e.g., how to think about bonds in a zero-interest rate environment). These ideas are fairly intuitive, and add up to an elegantly simple portfolio, but there is much disparity among managers on how to think about these concepts. Though Hedgewise gains confidence in its methodology through a great deal of research and historical pressure testing, its ability to consistently outperform the competition across many environments goes a long way towards validation.

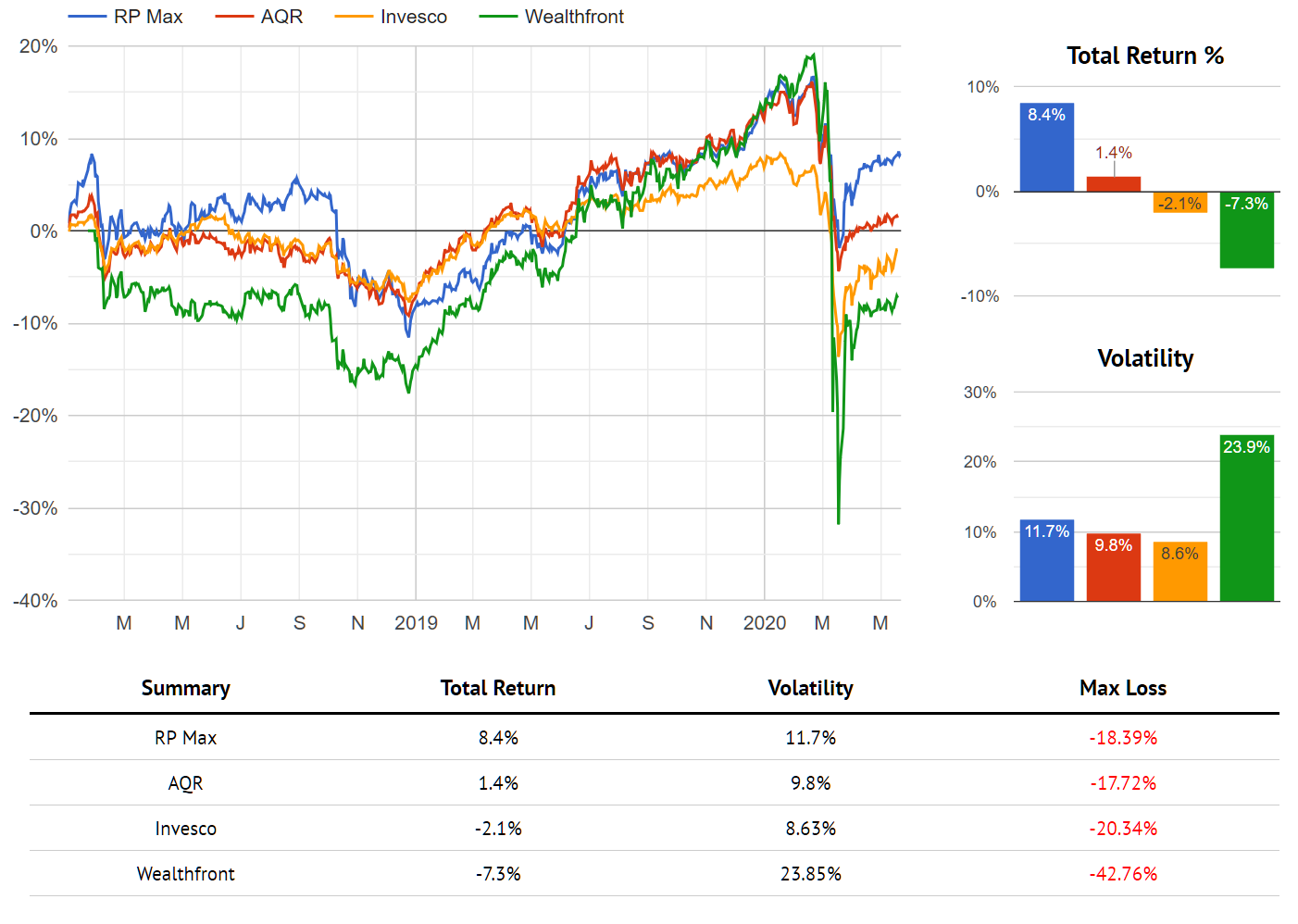

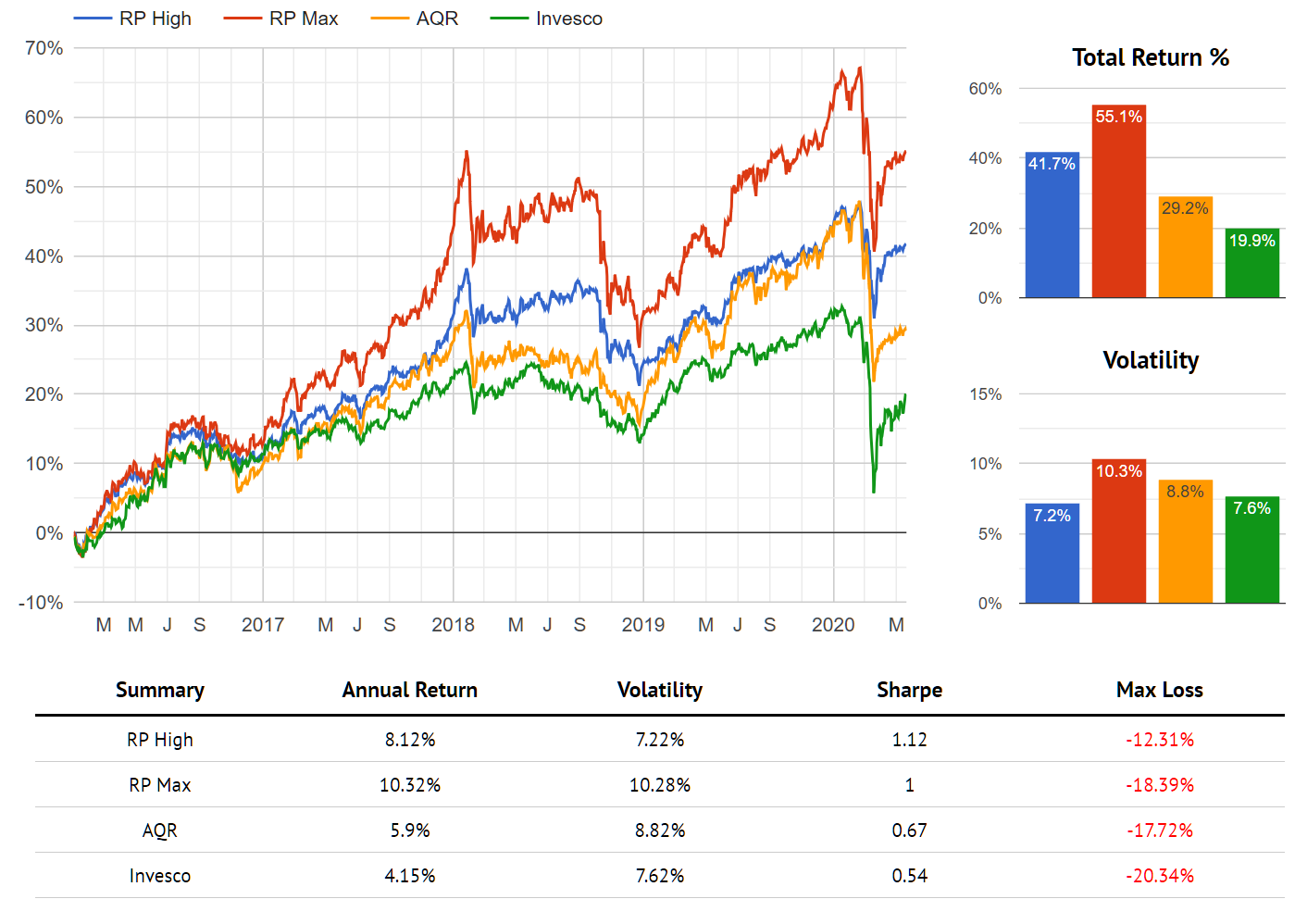

The period from 2018 through today has presented a highly challenging risk environment, with multiple asset class whipsaws due to trade wars, Federal Reserve misfires, and of course, the current pandemic. The following shows how the Hedgewise Risk Parity+ strategy performed vs. the competition.

Risk Parity+ vs. Major Competition, 2018 to Present

There was no avoiding a rocky path over this period - nearly any systematic strategy will deal with drawdowns in these environments - but Hedgewise still outperformed every alternative by at least 7% as of today. There are many details of managing risk that drove this difference, but most other providers suffered greater losses during the pandemic specifically because their portfolios are far more complex. The more complex the product, the more vulnerable it will be to a liquidity crisis like we had in March, and the more difficult it is to properly hedge. By limiting its portfolio to only highly liquid, well-hedged asset classes, Hedgewise avoids this pitfall without sacrificing any of the strategy's benefits.

To better prove this point, let's now extend the view back to 2016.

Risk Parity+ vs. Major Competition, 2016 to Present

Hedgewise has outperformed over the longer term by a total of 12% - 35%, depending on the competitive fund and risk level. This was achieved with similar levels of drawdown and a relatively high degree of correlation. Given the tail risk of the extra complexity in the other funds, you'd expect it would at least add to returns outside of crisis periods, but there is no evidence that this has happened.

Risk Parity, in theory, seems easy enough to implement. In practice, there are many more potential pitfalls than a traditional market-weighted index. While the Hedgewise approach may appear simple at first glance, it is based on a foundational understanding of risk that continues to differentiate itself as time goes on.

Looking Ahead: Approaching a Newly Unstable World

So far as Risk Parity+ is concerned, the pandemic has been "just another event," and it is for this very reason that it should continue to perform well. The strategy doesn't rely on any insight into the future, and thus it doesn't require deep analysis to forecast what it might do next. It's provided a rare bright spot in the last few months, and is a uniquely suitable investment option for whatever is on the horizon.

Unfortunately, the same cannot be said for most other traditional investing strategies. I don't have a strong view on how the economy or the health crisis will evolve in the near-term, but I do believe the pandemic has demonstrated worrying fissures in the global fabric of society and forced central banks to inject unavoidable instability into the financial marketplace.

In a largely rational world, Covid should never have had the impact that it has. Despite the fact that the world has now triaged its way back from the edge, it is impossible to deny that this experience indicates a failure of global leadership and individual behavior. This incidence suggests that political fissures around inequality, de-globalization, and partisanship now have a much greater likelihood of boiling over in a destructive manner.

Central banks have been forced to respond to this crisis by injecting incredible amounts of support into the financial system, namely bringing interest rates to zero and backstopping a huge amount of debt that would have otherwise fallen into default. The problem is this eliminates the viability of traditionally safe investments, and lowers the return on the entire investable universe. As a result, even risk-averse investors must pile into increasingly risky investments (e.g., equities, high-yield debt, etc.). Yet the risk inherent in these instruments does not go down simply because interest rates are so low; in fact, quite the opposite. When interest rates are zero in part because the world is handling a crisis really poorly, there's even more reason to suspect future crises will incur excessive damage.

This adds up to unreasonably elevated asset prices (since there are so few low risk alternatives) with lower expected returns and a greater chance of sudden drops. As an example, imagine a very risky company - let's say a cruise company, in our current environment - can sell a bond with a much lower interest rate than it could have before all of this. If that company goes on to default, investors will lose more money than they would have previously (since the bond started at a higher price), and will have received less interest along the way. This company's chance of default is always a constant value - but the Fed is changing the equation so that many more investors will now bear this risk without being compensated for it.

You wind up in a world with a greater likely incidence of damaging external events, and asset prices that are unreasonably high alongside it. How is an investor supposed to handle this?

There are no easy answers, but you essentially need a strategy built with instability and irrationality in mind, or you need to build a much higher degree of volatility and potential loss into your investment horizon than you had previously. Risk Parity is a unique systematic option for handling instability, but outside of that, you are left with various forms of active management along with its pitfalls. On the passive side, equities will still probably be the best long-term choice, but you'll have more frequent periods of loss and long-run returns may not be very high. Traditional diversifiers like Treasury bonds will no longer serve an effective role with interest rates so low, which will drastically limit the options outside of stocks.

It's going to be a challenging new world, and it is definitely not ideal, but the only choice is to navigate the reality in front of us as effectively as we can. I'm hopeful that perhaps global leadership can find its footing, and the populace behind it can rally behind long-term sustainability, mutual support, effective government, and scientific thinking. This may allow us to eventually get back to a more normal state. In the meantime, I'm glad to have Risk Parity as an option.

Disclosure

This information does not constitute investment advice or an offer to invest or to provide management services and is subject to correction, completion and amendment without notice. Hedgewise makes no warranties and is not responsible for your use of this information or for any errors or inaccuracies resulting from your use. Hedgewise may recommend some of the investments mentioned in this article for use in its clients' portfolios. Past performance is no indicator or guarantee of future results. Investing involves risk, including the risk of loss. All performance data shown prior to the inception of each Hedgewise framework (Risk Parity in October 2014, Momentum in November 2016) is based on a hypothetical model and there is no guarantee that such performance could have been achieved in a live portfolio, which would have been affected by material factors including market liquidity, bid-ask spreads, intraday price fluctuations, instrument availability, and interest rates. Model performance data is based on publicly available index or asset price information and all dividend or coupon payments are included and assumed to be reinvested monthly. Hedgewise products have substantially different levels of volatility and exposure to separate risk factors, such as commodity prices and the use of leverage via derivatives, compared to traditional benchmarks like the S&P 500. Any comparisons to benchmarks are provided as a generic baseline for a long-term investment portfolio and do not suggest that Hedgewise products will exhibit similar characteristics. When live client data is shown, it includes all fees, commissions, and other expenses incurred during management. Only performance figures from the earliest live client accounts available or from a composite average of all client accounts are used. Other accounts managed by Hedgewise will have performed slightly differently than the numbers shown for a variety of reasons, though all accounts are managed according to the same underlying strategy model. Hedgewise relies on sophisticated algorithms which present technological risk, including data availability, system uptime and speed, coding errors, and reliance on third party vendors.