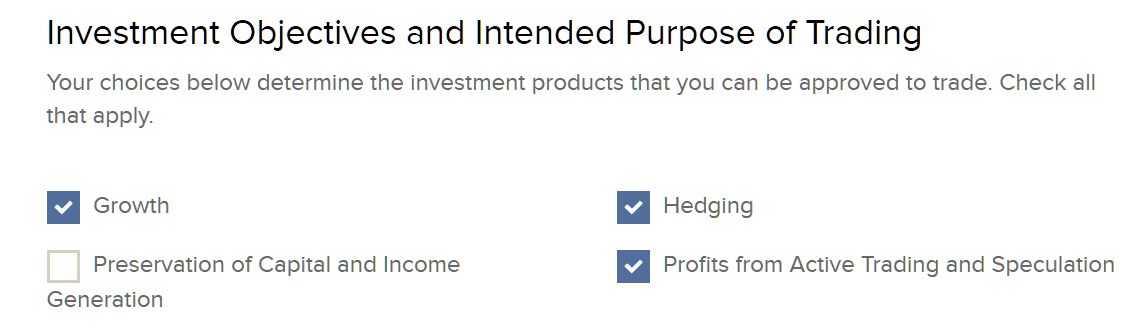

Step 1: Check Your Financial Information

Regulations require you to confirm the trading goals and investing experience of Hedgewise acting as your advisor.

1) Log-in to Interactive Brokers and navigate to Menu -> Settings -> Account Settings -> Financial Information.

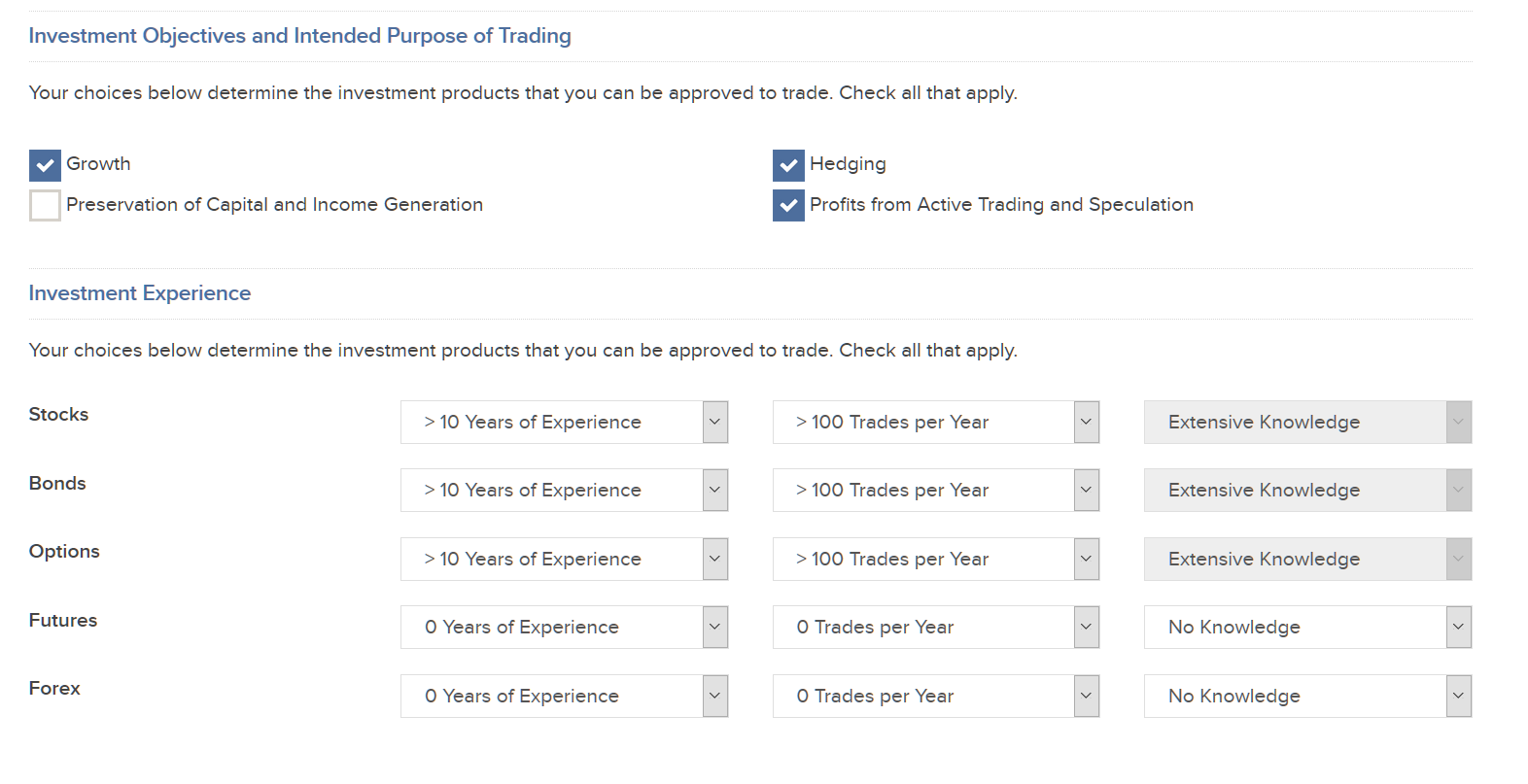

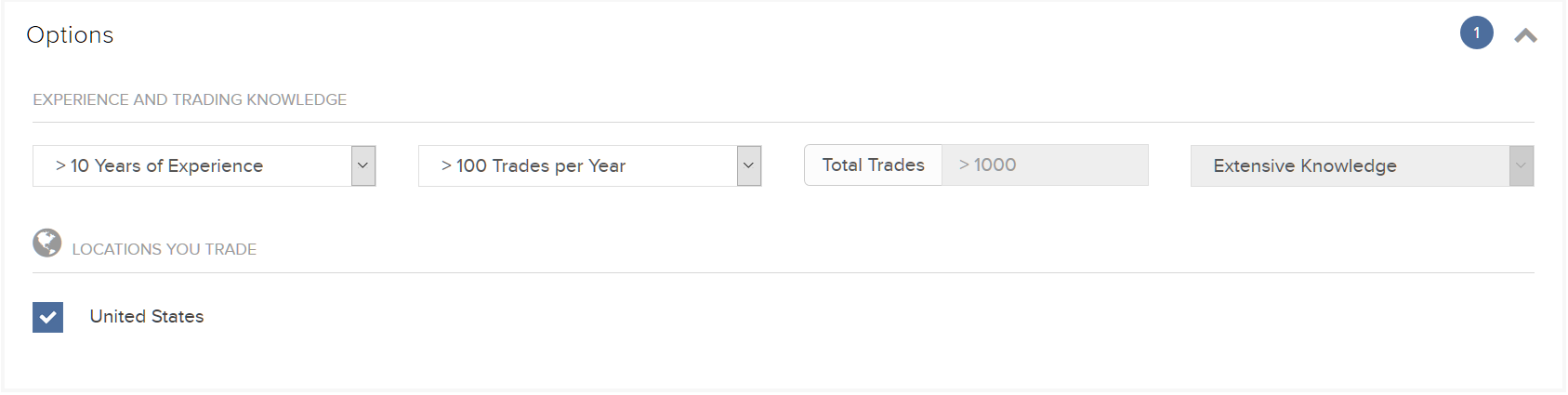

2) Update your Investment Objectives to be "Growth", "Hedging", and "Profits from Active Trading and Speculation". Indicate your Investment Experience in Stocks and Options (at a minimum) as >10 Years, >100 Trades Per Year, and Extensive Knowledge. This reflects the experience of Hedgewise as your advisor.

3) Press "Continue" and confirm any remaining steps. If you needed to change this information, you may have to wait 24 hours for this change to be processed before continuing to Step 2.

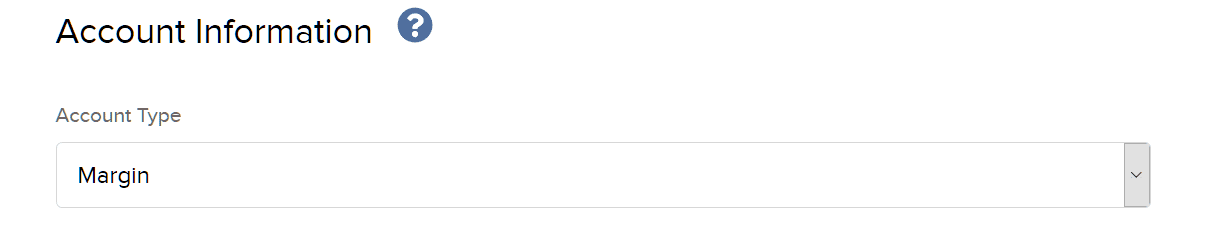

Step 2: Check your Account Type

Hedgewise requires the use of a 'margin' account, which helps avoid trading delays due to settlement procedures and gives you the ability to trade options contracts as needed. To check and/or change your account type, follow these instructions:

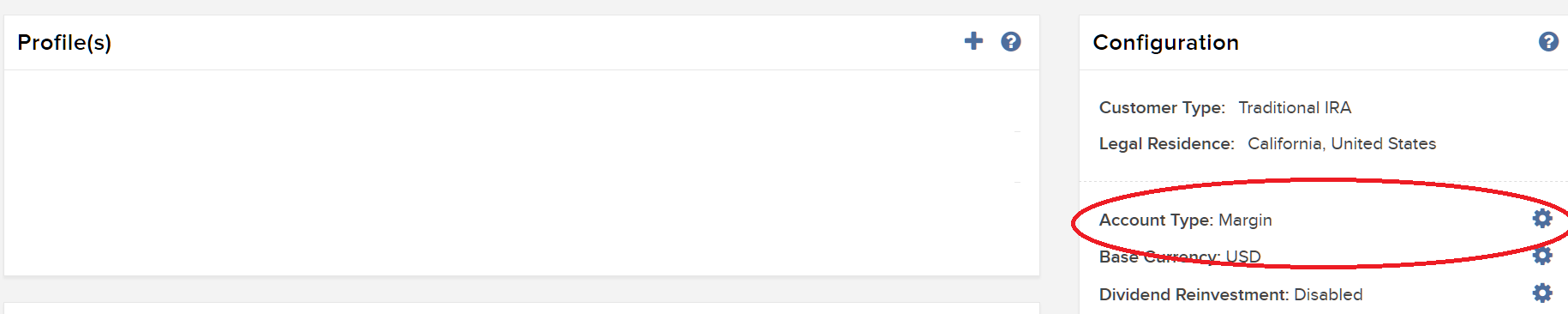

1) Navigate to Menu -> Settings -> Account Settings -> Account Type.

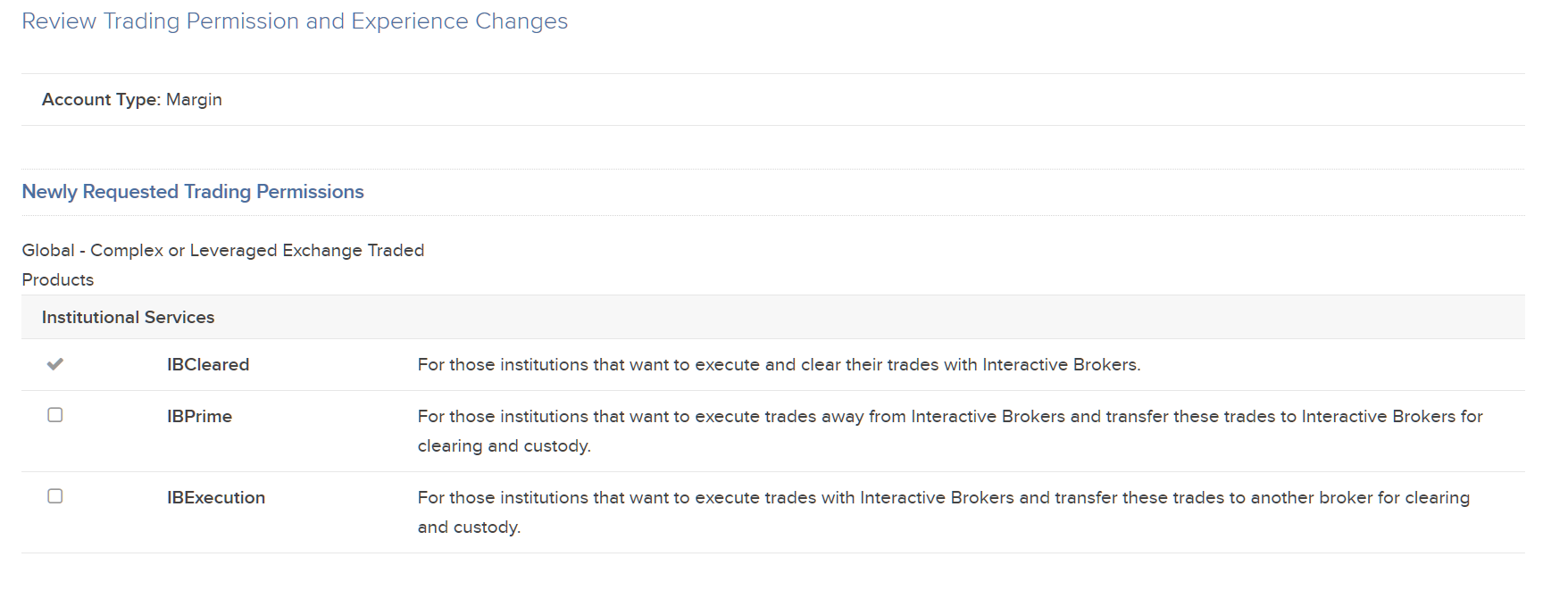

2) Set your Account Type as either "Margin" or "Reg T Margin". If you also need to change your trading permissions, select "Yes" below Account Type and proceed to Part 2 of Step 3. Otherwise, select "No".

3) Press "Continue" and confirm any remaining steps to upgrade your account.

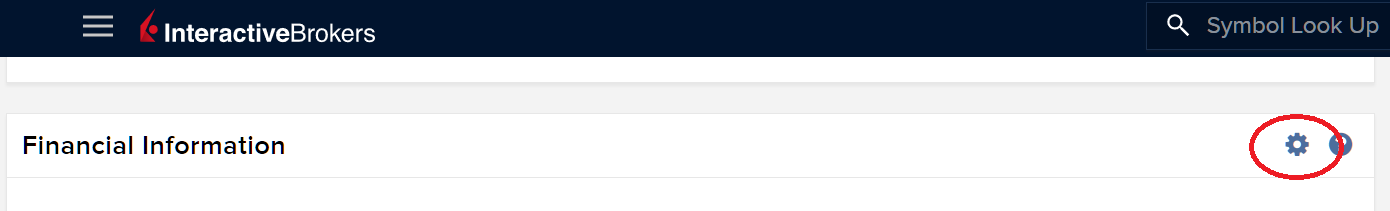

Step 3: Check Your Trading Permissions

Your account trading permissions must match those of Hedgewise for regulatory reasons.

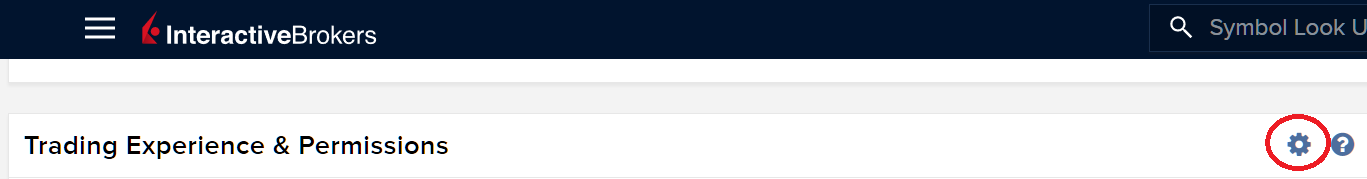

1) Navigate to to Menu -> Settings -> Account Settings -> Trading Experience and Permissions.

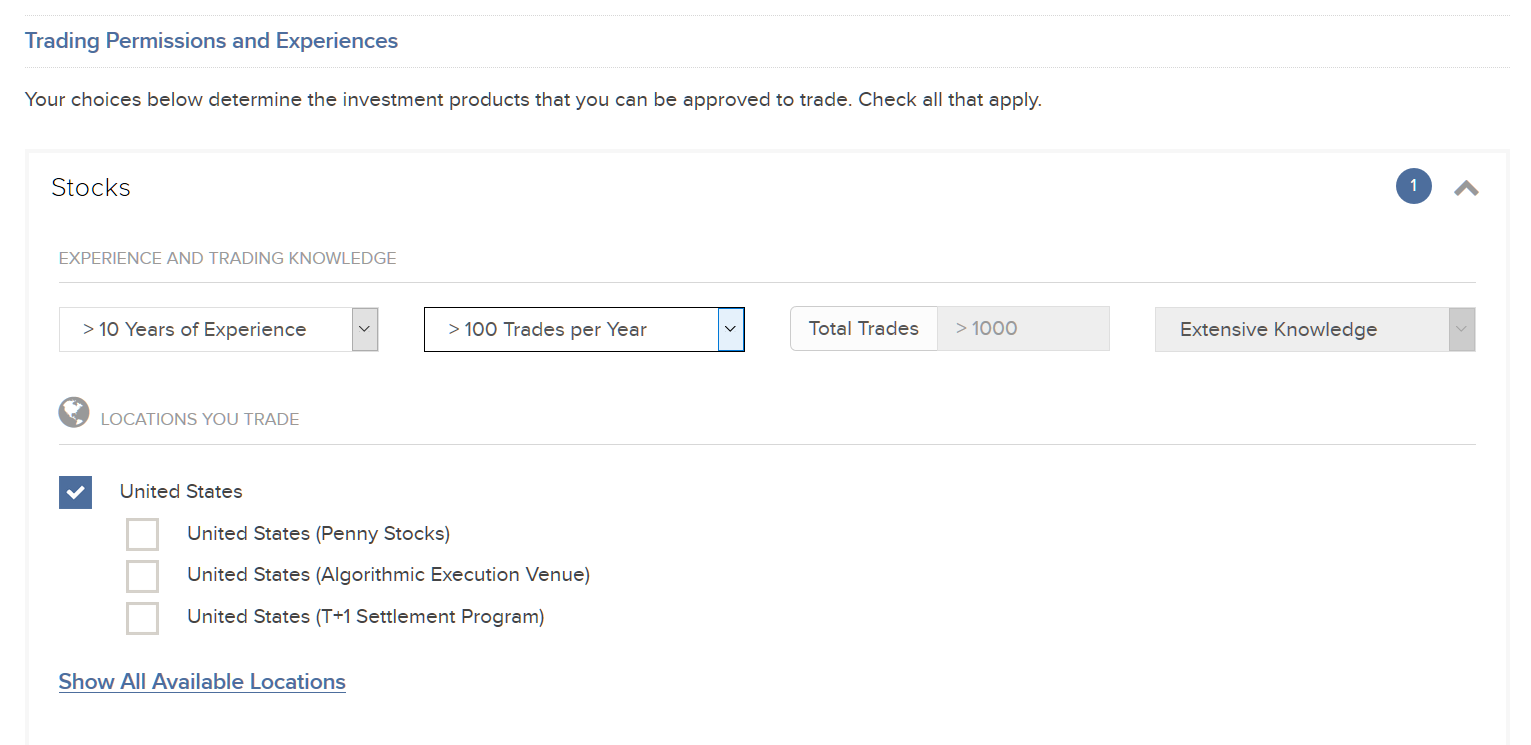

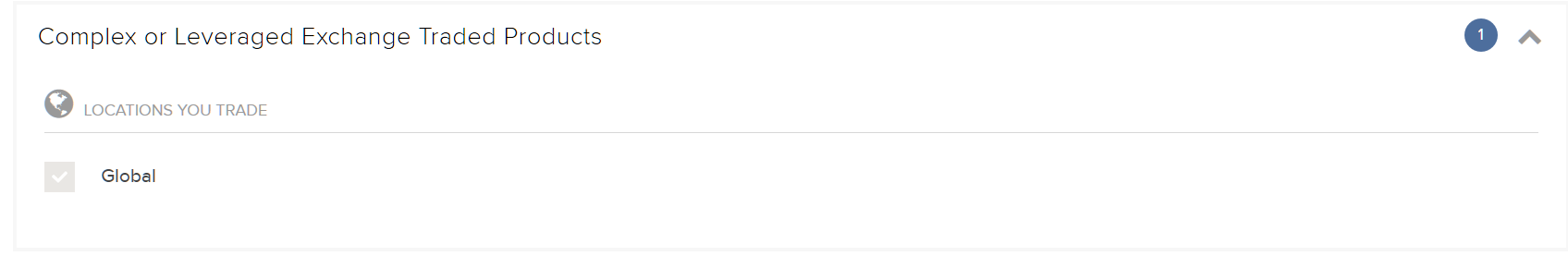

2) Ensure that Stocks, Options, and Complex or Leveraged Exchange Traded Products are all permissioned. To update this, either click the gear button or select the linked titled "Request Trading Permission" next to the category. Indicate your Investment Experience in Stocks and Options as >10 Years, >100 Trades Per Year, and Extensive Knowledge and select permission in the United States. For Complex ETFs or Leveraged Exchange Traded Products, select "Global" permission.

4) Press Continue. On the confirmation page, choose "IBCleared" if given the option.

5) Press "Continue" and confirm any remaining steps to upgrade your account.

Step 3: Link Account to Hedgewise

Note that this step is not necessary if you set-up your account through an e-mail invitation from Hedgewise. You will also not be able to link any account that is already managed by another advisor.

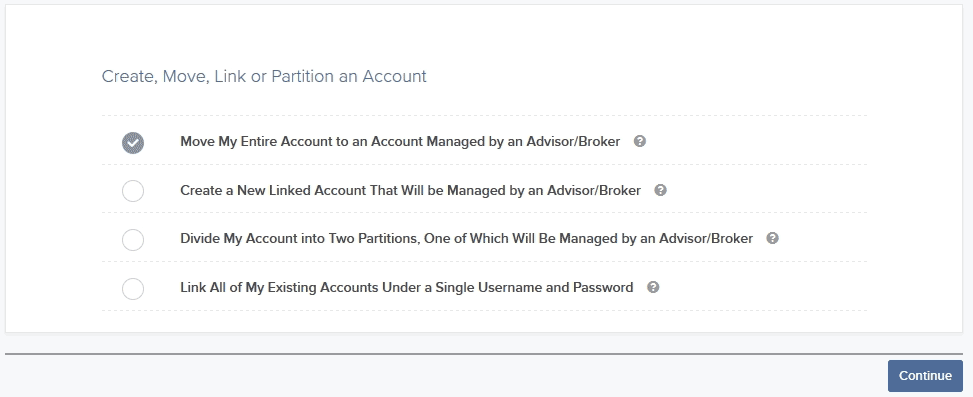

1) Navigate to Settings -> Account Settings. In the Configuration panel on the right side of the screen, click the icon next to Create, Move, Link, or Partition an Account.

2) Select the radio button next to Move my Entire Account to an Account Managed by an Advisor or Broker, and then click Continue.

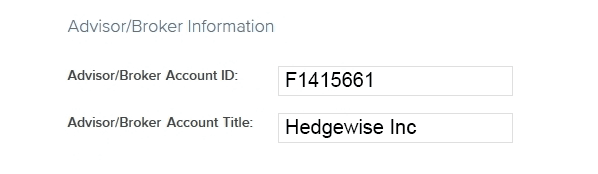

3) Enter our Advisor Identification information as follows:

Account ID: F1415661

Account Title: Hedgewise Inc

4) Click Continue and complete the remaining forms.

Interactive Brokers Disclosure

Interactive Brokers LLC is a registered Broker-Dealer, Futures Commission Merchant and Forex Dealer Member, regulated by the U.S. Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA), and is a member of the Financial Industry Regulatory Authority (FINRA) and several other self-regulatory organizations. Interactive Brokers is not affiliated with and does not endorse or recommend any introducing brokers or financial advisors, including Hedgewise Inc. Interactive Brokers provides execution and clearing services to customers of Hedgewise Inc. For more information regarding Interactive Brokers, please visit www.interactivebrokers.com.

Disclosure

This information does not constitute investment advice or an offer to invest or to provide management services and is subject to correction, completion and amendment without notice. Hedgewise makes no warranties and is not responsible for your use of this information or for any errors or inaccuracies resulting from your use. Hedgewise may recommend some of the investments mentioned in this article for use in its clients' portfolios. Past performance is no indicator or guarantee of future results. Investing involves risk, including the risk of loss. All performance data shown prior to the inception of each Hedgewise framework (Risk Parity in October 2014, Momentum in November 2016) is based on a hypothetical model and there is no guarantee that such performance could have been achieved in a live portfolio, which would have been affected by material factors including market liquidity, bid-ask spreads, intraday price fluctuations, instrument availability, and interest rates. Model performance data is based on publicly available index or asset price information and all dividend or coupon payments are included and assumed to be reinvested monthly. Hedgewise products have substantially different levels of volatility and exposure to separate risk factors, such as commodity prices and the use of leverage via derivatives, compared to traditional benchmarks like the S&P 500. Any comparisons to benchmarks are provided as a generic baseline for a long-term investment portfolio and do not suggest that Hedgewise products will exhibit similar characteristics. When live client data is shown, it includes all fees, commissions, and other expenses incurred during management. Only performance figures from the earliest live client accounts available or from a composite average of all client accounts are used. Other accounts managed by Hedgewise will have performed slightly differently than the numbers shown for a variety of reasons, though all accounts are managed according to the same underlying strategy model. Hedgewise relies on sophisticated algorithms which present technological risk, including data availability, system uptime and speed, coding errors, and reliance on third party vendors.