Summary

- Over the last week and a half, the Hedgewise strategy has experienced a small correction as many different asset classes had simultaneous losses.

- While such periods will be difficult to bear, it is helpful to understand how the underlying investment principles are still working as they should.

- In these environments, Hedgewise helps to minimize your losses while giving you a better chance of a positive return moving forward.

- Losses are typically short-lived, and tend to be followed by positive reversals. Maintaining a long-term outlook is crucial to achieving outperformance over time.

- If you are uncomfortable with the current volatility of your portfolio, you can always choose a lower Target to further minimize your risk of loss.

Overview

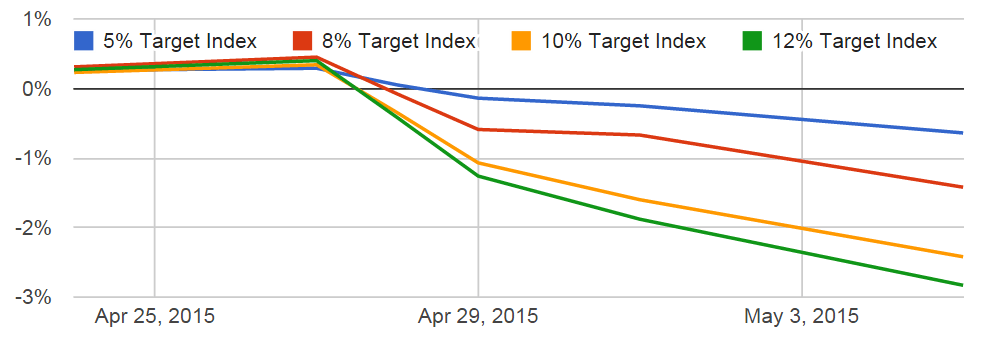

It has been a rough week in the markets. Over the past 10 days or so, here's a look at the performance of each of the Hedgewise Target Portfolios.

Figure 1: Performance of Hedgewise Target Portfolios, April 24 - May 5

While this is always difficult to experience, the Hedgewise strategy continues to demonstrate the power of its underlying principles, which maximize the opportunity for a positive return moving forward. By studying the nature of the portfolio's losses this week, as well as their relationship to the underlying economic environment, we can better understand why.

Moderating Losses Across the Board

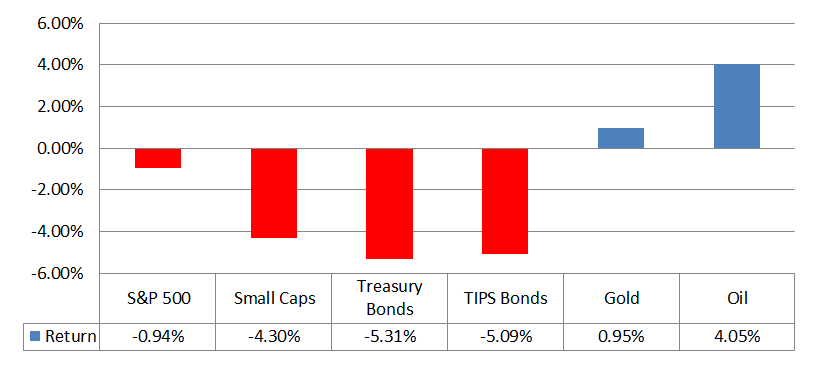

This was a rare week when nearly every major asset class lost money at once.

Figure 2: Performance of Major Asset Classes, April 24 - May 5

In such an environment, nearly any investment strategy is bound to lose money, unless you are in cash, shorting the market, or betting 100% on oil. Over any long term horizon, however, these strategies are almost guaranteed to underperform.

Given that, the goal in this scenario is twofold: minimize your losses and ensure that the overall risk of your portfolio is in line with your expectations. Hedgewise has continued to do both things for its investors.

By comparing Figures 1 and 2, you'll notice that the Hedgewise Target portfolios outperformed Treasury Bonds, TIPS Bonds, and Small Cap Stocks, while underperforming the S&P 500, Gold, and Oil. This 'hedging' is by design, as by spreading your bets across asset classes, you avoid the risk of a crash in any single place.

Secondly, you'll notice in Figure 1 that losses in our Target 5% portfolio were far less than losses in our Target 12% portfolio. Scenarios like this one are excellent ways to calibrate your personal tolerance for risk, and ensure that you are comfortable with short-term volatility when it occurs. If you find that these recent losses are too much to bear, you have the choice to lower the overall risk of your portfolio at any time.

Still, it is never fun to lose money, even if those losses are hedged. The good news is that such losses are typically short-lived. In fact, the bigger the loss, the more likely it is that returns will be higher in the near future, as counterintuitive as that may feel.

The Impact of Losses on Future Returns

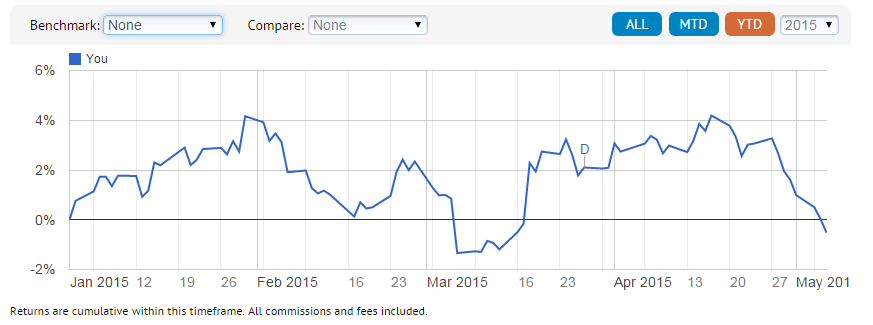

Like any investment, corrections are inevitable. After such a correction occurs, though, it means that many assets are now cheaper, and rebalancing into these cheaper assets will probably 'boost' your return when they do recover. This can be seen from January to March this year, when Hedgewise experienced a sudden downturn, only to recover almost immediately after. While we are experiencing another down period now, it would not be surprising if history continues to repeat itself.

Real Client YTD Performance, Target 10% Portfolio

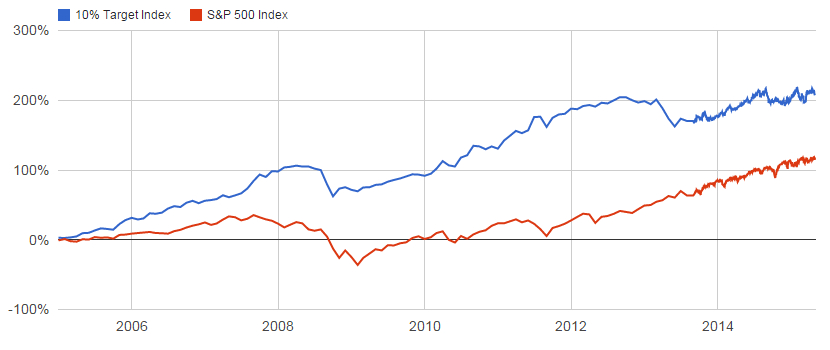

You can also expand this concept to our longer-term performance since 2005, during which there were many corrections despite strong overall returns.

Target 10% Strategy Index Performance Since 2005

In most investments, crashes are often followed by periods of outperformance. The Hedgewise strategy will follow a similar pattern, but with the advantage of more effective diversification along the way.

Why the Current Environment is Unlikely to Last

These principles would remain the same no matter the economic environment, but there is also reason to believe that the current pattern of losses is unlikely to continue.

The Hedgewise portfolio is balanced to maximize the chance that a crash in one asset will be offset by a gain in another. Most recently, stocks, nominal bonds, and inflation-protected bonds (TIPS) all went down at once, which is a relatively rare situation which limits the effectiveness of hedging. This situation is rare because it implies that investors are worried about different scenarios which are very unlikely to co-exist.

If nominal and TIPS bonds are both losing value, it means that investors are assuming a higher rate of real economic growth. However, a stronger economy would generally boost stocks, which have also experienced recent losses. This suggests that investors are simply unsure, and have moved to the sidelines until the signals get clearer. If the economy is indeed strong, stocks will likely recover, and vice versa for bonds.

No matter which way it turns next, the Hedgewise portfolio remains prepared, and frees you from having to predict the future.

Hopefully this context helps to give you better perspective on the most recent week, and ease any concerns about the future of the Hedgewise strategy. Even in difficult periods like these, Hedgewise is helping you invest safer, smarter, and at the risk you choose.

Disclosure

This information does not constitute investment advice or an offer to invest or to provide management services and is subject to correction, completion and amendment without notice. Hedgewise makes no warranties and is not responsible for your use of this information or for any errors or inaccuracies resulting from your use. Hedgewise may recommend some of the investments mentioned in this article for use in its clients' portfolios. Past performance is no indicator or guarantee of future results. Investing involves risk, including the risk of loss. All performance data shown prior to the inception of each Hedgewise framework (Risk Parity in October 2014, Momentum in November 2016) is based on a hypothetical model and there is no guarantee that such performance could have been achieved in a live portfolio, which would have been affected by material factors including market liquidity, bid-ask spreads, intraday price fluctuations, instrument availability, and interest rates. Model performance data is based on publicly available index or asset price information and all dividend or coupon payments are included and assumed to be reinvested monthly. Hedgewise products have substantially different levels of volatility and exposure to separate risk factors, such as commodity prices and the use of leverage via derivatives, compared to traditional benchmarks like the S&P 500. Any comparisons to benchmarks are provided as a generic baseline for a long-term investment portfolio and do not suggest that Hedgewise products will exhibit similar characteristics. When live client data is shown, it includes all fees, commissions, and other expenses incurred during management. Only performance figures from the earliest live client accounts available or from a composite average of all client accounts are used. Other accounts managed by Hedgewise will have performed slightly differently than the numbers shown for a variety of reasons, though all accounts are managed according to the same underlying strategy model. Hedgewise relies on sophisticated algorithms which present technological risk, including data availability, system uptime and speed, coding errors, and reliance on third party vendors.