Summary

- Real interest rates continue to swing around wildly, despite little news of note regarding the long-term growth and inflation outlook. While this is contributing to significant volatility in the Hedgewise portfolio, longer-term risk is declining every day that rates remain this high.

- The economy is naturally restricted by real interest rates above underlying real growth, which is driven exclusively by worker productivity and population. These factors are unaffected by fiscal deficits, bond auctions, and supply/demand curves. If the current real rate is above this level of growth, the economy will be constricted.

- Long-term real expected GPD growth is estimated to be 1.8%, and the long-term real interest rate is currently near 2.5%. This dynamic will negatively impact the economy, thus limiting its ability to persist. The longer it continues, the more future growth will suffer (and the lower future interest rates will likely be).

- Since these rates are unsustainable, Hedgewise focuses on how to systematically take advantage of the situation. Ironically, the best opportunities arise the longer that rates stay high, and the slower that they come down.

Bonds Feel Scary, but They Are Not

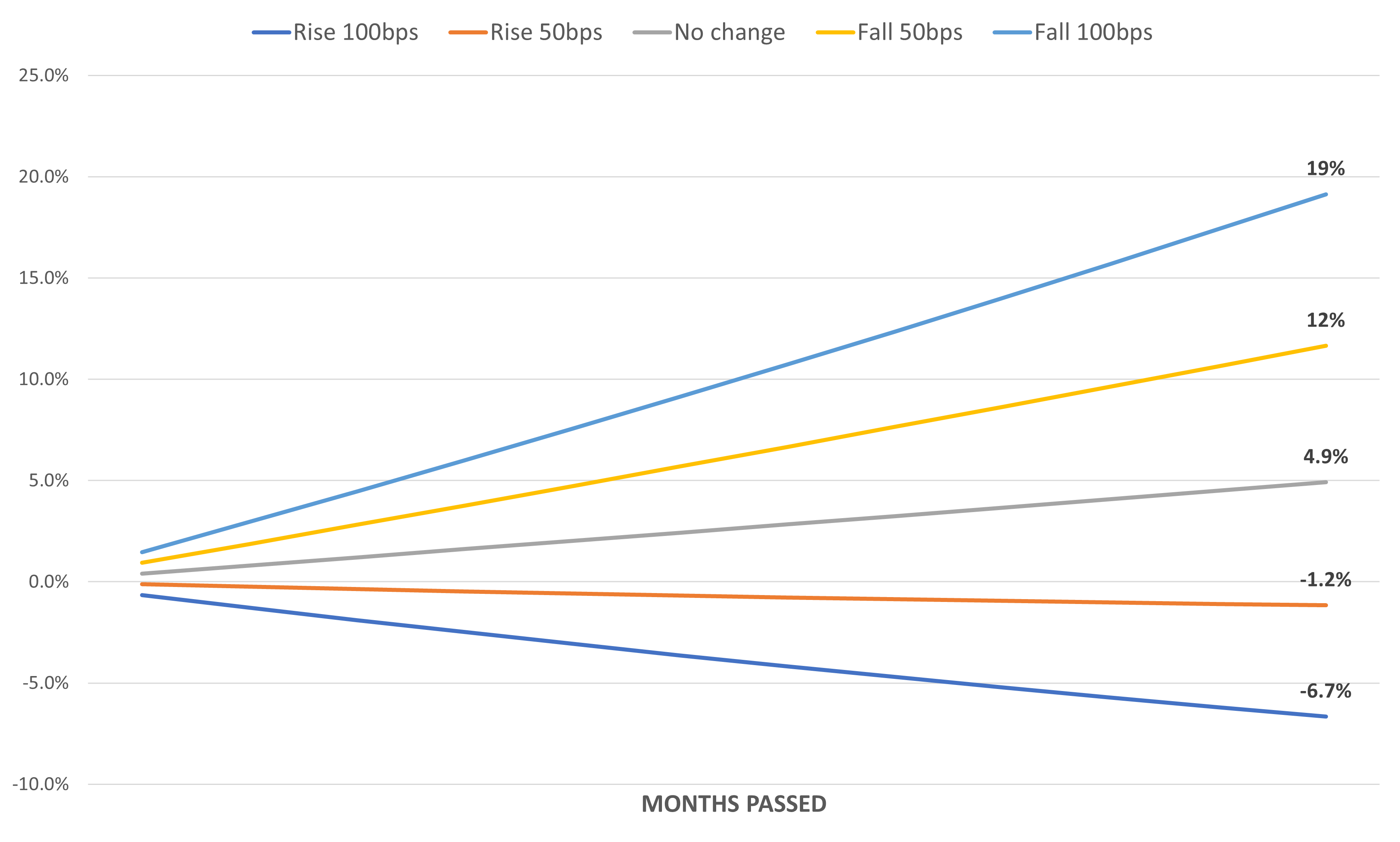

For a moment, put aside the crazy bond market volatility over the past few months, and consider the following. If you invest in 20yr Treasuries at 4.85%, you will gain 12% over the next 12 months if rates fall 50bps, and you will lose 1.1% if rates rise 50bps. Expanding on this, here is a view of expected 20yr Treasury performance across a variety of interest rate scenarios over the next 12 months.

Bond Scenarios Over Next 12 Months

If you have a time horizon of at least one year, it will be very difficult to lose money with these bonds. Even if rates rise all the way to 5.85%, which would be extreme for many different reasons, further losses would be limited to under 7%. This perspective is easily lost amidst the significant volatility over the last two months, but it is far more important than what is happening day-to-day, and a much more accurate picture of true "risk".

This picture improves even further if you add on a layer of probability. Given that real rates are now the highest in the past 25 years, and meant to be restrictive on the economy, there is a much better chance that rates will fall than that they will rise.

If you can maintain this broader perspective, the recent volatility is much easier to tolerate. What happens over a few days or weeks has little to do with the 12-month horizon. To the extent that rates become more restrictive over the short-term, this increases the chance of lower long-term rates because it will tighten financial conditions and threaten growth.

A challenging aspect to this story is that it was already true when rates were at 4%, and the sheer size and speed of the recent losses can create a sense of panic and second guessing. However, it is very risky to try and time losses as rates go from somewhat restrictive to very restrictive. Not only is it unlikely to persist for very long, but you also miss out on higher coupon payments along the way. Instead, Hedgewise avoids these pitfalls by systematically adding to its exposure as rates go higher, which increases long-term expected returns without any timing risk.

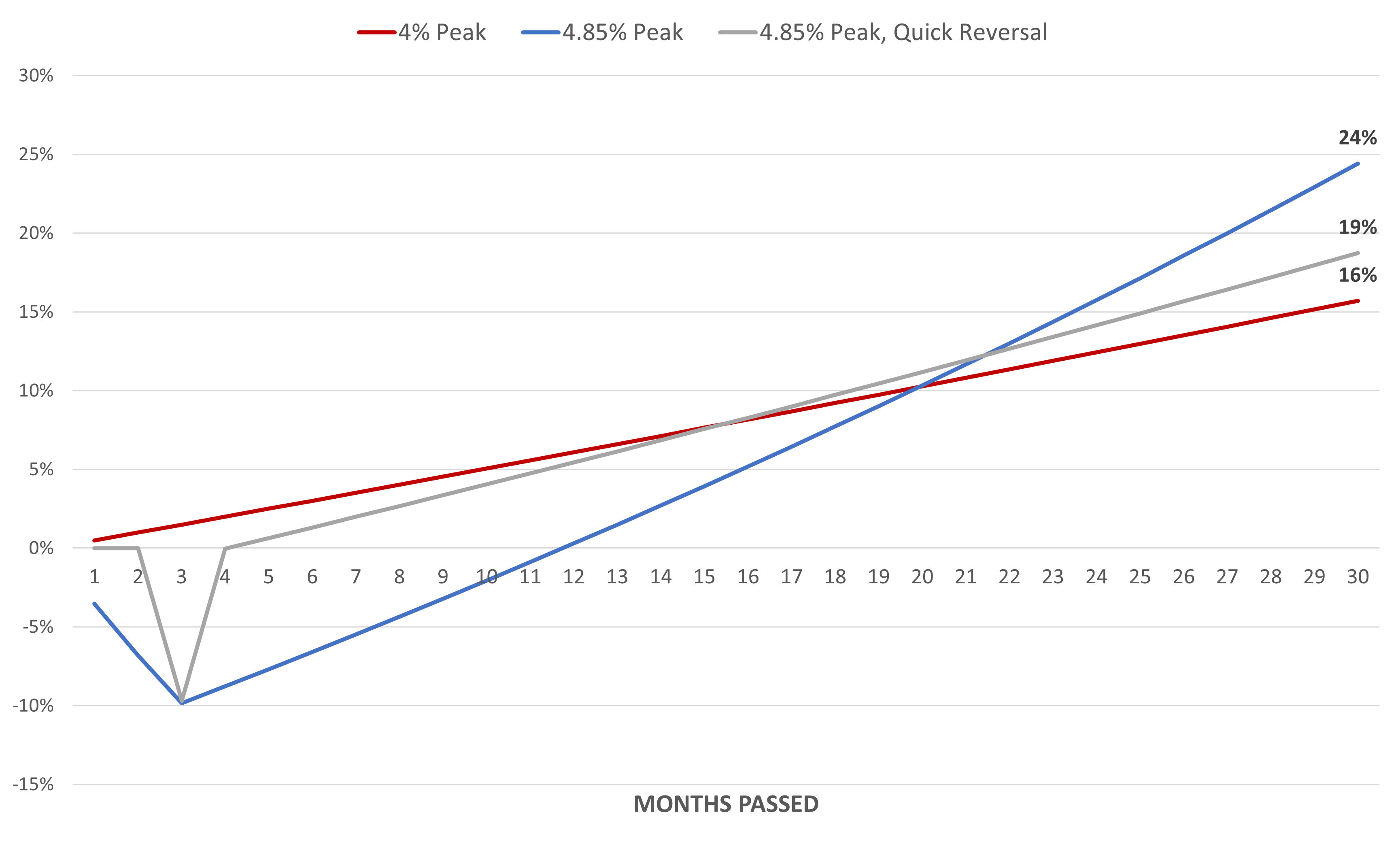

A useful way to visualize this is to rewind back to July, when 20yr rates were near 4%, and compare different expected three-year outcomes. In the following graph, the first scenario assumes that rates never exceeded 4% after July and fell slowly to 3.5% by 2026. The second scenario allows rates to rise just as they have over the past few months before falling to the same 3.5% by 2026.

July 2023 Three-Year Bond Scenarios: 4% Peak vs. 4.85% Peak

The difference between the two scenarios is driven primarily by the assumption that bond exposure is increased by 15-25% once rates peak at 4.85%. Provided that occurs, there is no doubt that the higher interest rate scenario is preferred despite the initial drawdown. However, the exact amount of additional exposure depends partially on bond volatility. The longer that bonds are stable near the peak, the higher the chance that the second scenario is fully realized. On the other hand, if rates quickly reverse course, there is less potential opportunity, as shown by the third line below.

July 2023 Three-Year Bond Scenarios: 4% Peak vs. 4.85% Peak vs. Quick Reversal

So, all else equal, we prefer interest rates to overshoot, and we prefer for them to stay there a while. This may be uncomfortable due to the initial drawdown, and dramatic intraday volatility may fray nerves further. Yet it is still the optimal outcome, and there truly is little long-term danger. Even if rates stay at 4.85% until 2026, you will have been paid that coupon throughout while maintaining the potential upside. The logic remains true at a peak rate of 5%, 5.5%, and even 6%.

The single key underlying assumption is that interest rates above 3% truly are restrictive. That isn't really the debate happening in the market right now; most pundits are focused on the fiscal deficit and the inability to find enough buyers for an increasingly large amount of government debt. If that is the main story, it is only making already painful rates hurt even more (because a large debt auction has no offsetting positive macroeconomic impact). There is no ending besides one where the economy slows or reverses.

The only scenario where such high rates are not restrictive is one where real economic growth is extraordinarily strong, which has nothing to do with these supply/demand issues. To provide some context, the Fed estimates the neutral real rate of interest to be about ~1% under real annual GDP growth. To justify a real rate of 2.5% (where it is around now), real GDP growth would need to average 3.5%. Historically, this rate averaged 2.0% in the 2010s, 1.9% in the 2000s, 3.2% in the 1990s, and 3.1% in the 1980s. It is exceedingly difficult to imagine we are entering the fastest period of growth in the past 40 years, but this is what would need to make sense to worry about whether these rates are here to stay.

This may suggest the potential impact of AI, but that theory has several holes in it. If that technology is going to supercharge global growth, it wouldn't only impact the US while Europe and China struggle as they have been recently. It also doesn't follow that the catalyst for higher rates would be increased Treasury debt issuance, as opposed to news about AI's impact on earnings and employment. Even if AI has some real role, the current level of rates would already account for faster growth than the dot-com era.

However, the main takeaway is not about predicting the future or figuring out exactly what is going on with interest rates. The point is that the potential outcomes are lopsided to the upside. Over the next year, even another 0.5% increase in the 20yr rate will be almost fully offset by ongoing coupon payments. If the economy is being restricted at these levels, it is essentially assured that rates will come down. The more restrictive rates become and the longer they persist, the lower the eventual terminal rate is expected to be. Even if AI really is the next coming of the internet, and fiscal spending continues unabated, the current real interest rate already accounts for these factors. It is very hard to envision a world where 20yr bonds are a poor investment over the next few years.

I have no idea what will happen day-to-day, and volatility will likely continue until this all has time to work through the real economy. But from a 12-month perspective, there is little reason to worry and more reason to cheer on the crazy swings so we can take advantage of it - with no timing required.

Disclosure

This information does not constitute investment advice or an offer to invest or to provide management services and is subject to correction, completion and amendment without notice. Hedgewise makes no warranties and is not responsible for your use of this information or for any errors or inaccuracies resulting from your use. Hedgewise may recommend some of the investments mentioned in this article for use in its clients' portfolios. Past performance is no indicator or guarantee of future results. Investing involves risk, including the risk of loss. All performance data shown prior to the inception of each Hedgewise framework (Risk Parity in October 2014, Momentum in November 2016) is based on a hypothetical model and there is no guarantee that such performance could have been achieved in a live portfolio, which would have been affected by material factors including market liquidity, bid-ask spreads, intraday price fluctuations, instrument availability, and interest rates. Model performance data is based on publicly available index or asset price information and all dividend or coupon payments are included and assumed to be reinvested monthly. Hedgewise products have substantially different levels of volatility and exposure to separate risk factors, such as commodity prices and the use of leverage via derivatives, compared to traditional benchmarks like the S&P 500. Any comparisons to benchmarks are provided as a generic baseline for a long-term investment portfolio and do not suggest that Hedgewise products will exhibit similar characteristics. When live client data is shown, it includes all fees, commissions, and other expenses incurred during management. Only performance figures from the earliest live client accounts available or from a composite average of all client accounts are used. Other accounts managed by Hedgewise will have performed slightly differently than the numbers shown for a variety of reasons, though all accounts are managed according to the same underlying strategy model. Hedgewise relies on sophisticated algorithms which present technological risk, including data availability, system uptime and speed, coding errors, and reliance on third party vendors.