Summary

- As it becomes increasingly likely that we are entering a rising interest rate environment, both bonds and stocks face limited potential upside with significant potential downside.

- This raises doubts about the current viability of the traditional retirement portfolio mix of 50% stocks / 50% bonds.

- Similar environments in the past, such as the early 1970s and 2000s, have proven that this mix will often perform badly, with both asset classes vulnerable to downside shocks.

- We examine why allocating 10-25% of your portfolio to commodities is one of the smartest ways to stay protected as rates begin to rise.

Introduction: The Rising Interest Rate Retirement Conundrum

If you are currently retired or close to it, the current investment environment presents quite a minefield. Stocks are in one of the longest bull markets in history, and are unlikely to rally much further as capital becomes more expensive. If interest rates rise, bonds will also perform badly by definition. How, then, can a retiree be comfortable with something like the Vanguard Target Retirement 2025 Fund, which is basically a split of 50% in the S&P 500 (SPDR S&P 500 (SPY)) and 50% in intermediate bonds (Vanguard Total Bond Market (BND))?

Unfortunately, this kind of mix is simply ill-equipped to handle rising interest rates. The entire premise of diversification fails to work since higher inflation (the true driver of higher rates) tends to affect both stocks and bonds negatively. Without any adjustment, this can result in a portfolio with zero or even negative real returns over an extended timeframe.

Fortunately, there is another oft overlooked asset class that tends to perform quite splendidly in just these circumstances: commodities. Real assets like gold, oil, and base metals all naturally outperform during inflationary periods by definition: if one dollar now buys less, one ounce of gold will then cost more.

While many investors may dismiss commodities as 'too risky', history has shown quite the opposite, especially during rising interest rate environments. With many commodity prices already near decade lows due to a recently surging US dollar and weaker global demand, this is also the only asset class that currently looks like a bargain.

Read on to see why adding 10 to 25% exposure to commodities is the smart move for retirement investors in a rising interest rate environment. We also offer advice on specific portfolio mixes and how to most effectively invest in commodities.

A Quick Review: Rising Interest Rates and Commodities

First, a quick recap of how and why the Fed controls interest rates. The Fed has a dual mission of sorts: first, to keep inflation between 2-3%. Second, to keep unemployment and general economic calamity to a minimum. It's important to understand that the Fed will never raise rates unless inflation is at risk of exceeding its target range. If unemployment keeps getting lower and the economy is booming, but inflation is still at a healthy 2%, rates simply will not rise.

This fact is important because it provides the link for why commodities will tend to do so well during periods of rising interest rates. If the Fed is worried, it's because prices of real assets are increasing too quickly - for example, the prices of energy, food, and raw materials. If commodity prices remain low, on the other hand, it's also pretty unlikely that rates will actually go up.

With that in mind, let's take a look at a couple of periods in history that show this linkage in action, as well as the limitations of the traditional stock/bond portfolio during those same times.

Early 1970s: The Beginning of Stagflation

The average inflation rate from 1970-1979 was a whopping 7.06%, spurred on by the oil crises of 1973 and 1979 as well as ineffective monetary policy. Traditional investors found little respite throughout the decade. Note that all performance graphs include dividends and coupons reinvested and are based on index price levels.

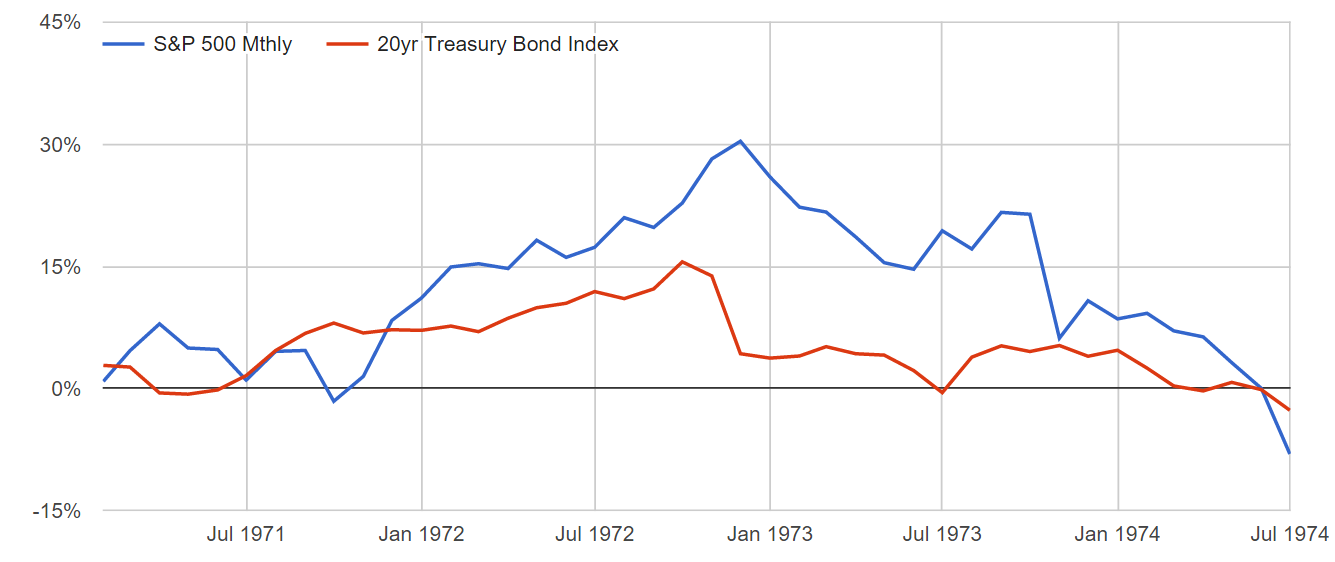

Performance of the S&P 500 and 20 Year Treasuries, February 1971 - July 1974

After the first half of the decade, stocks were down 8% and bonds were down 3%. Even worse, inflation was already accelerating, pushing real returns down even further. The Effective Fed Funds Rate rose from 4% to over 12% during this timeframe.

You might notice that stocks did quite a bit better than bonds for the first couple of years, only to then fall off precipitously. This is typical of rising rate environments: while stocks are initially more resilient to inflationary pressure than bonds, there is the constant lurking risk of a recession due either to runaway inflation or the high cost of capital. Without a crystal ball, neither asset class can be considered 'safe'.

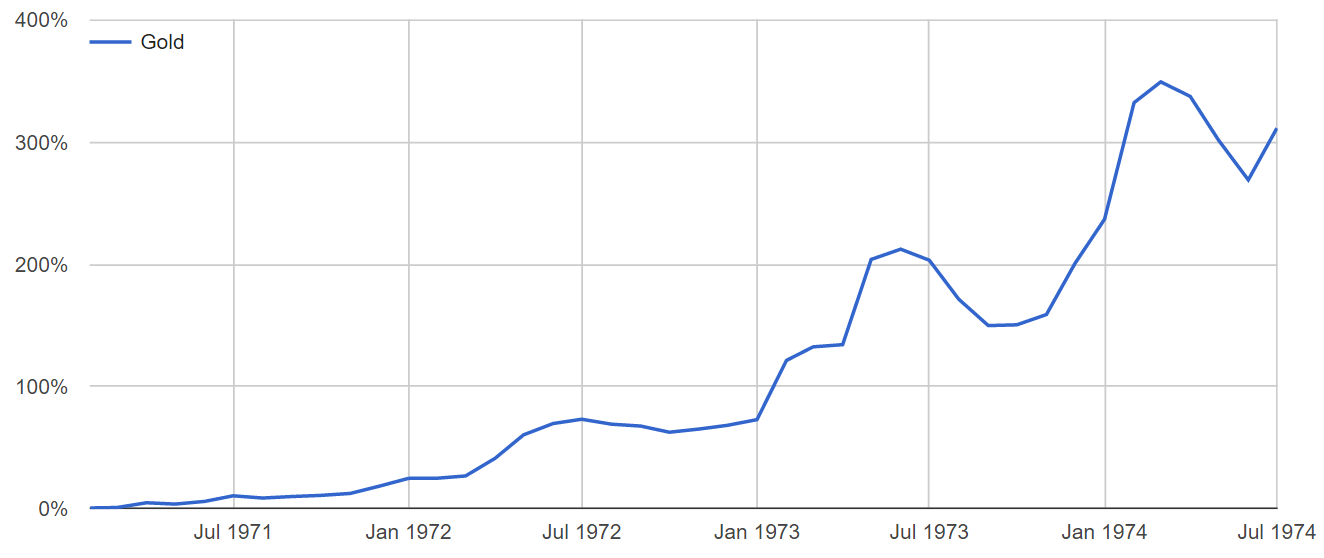

During this time, the United States exited the Bretton Woods system, which pegged the US dollar to the price of gold. As a result, gold became a freely traded commodity, and began exhibiting just the kind of performance you'd expect during periods of high inflation.

Performance of Gold, February 1971 - July 1974

There was also the first 'oil shock' in 1973, which sent the price of oil soaring and was a big reason for the inflationary pressure at the time. This goes back to the point: if rates are rising, it's very likely connected to higher prices of raw materials. All commodity prices will tend to go up together, since a weaker dollar makes all real assets more expensive.

That said, many consider this decade an outlier because of the specific politics of the time. Gold may have been underpriced already due to the Bretton Woods system, and it took a major oil embargo to so radically shift the price of oil. However, we saw these same trends happen again in the years after the 'Dot Com' crash, without any notable political interference.

Post Dot Com Bubble: 2004 to 2006

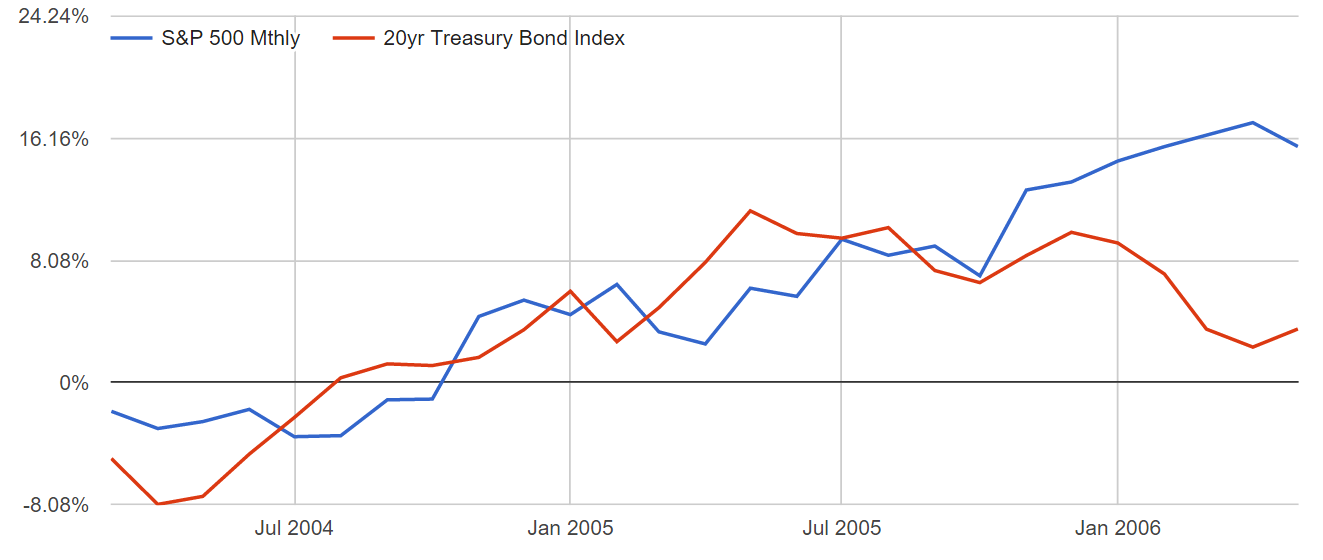

The Effective Fed Funds Rate reached a low of 1% in 2003, and then began rapidly rising over the next two years, reaching over 5% by mid-2006. While many remember this period as a great economic expansion, fueled by booming real estate, the stretch of rising rates actually wasn't a great time for traditional retirement investors.

Performance of the S&P 500 and 20 Year Treasuries, March 2004 - May 2006

While at first glance, this doesn't look terrible, the real annualized returns of a 50/50 portfolio were relatively paltry, equaling about 1.6% after taking inflation into account. Meanwhile, here's how gold and oil performed over this same timeframe.

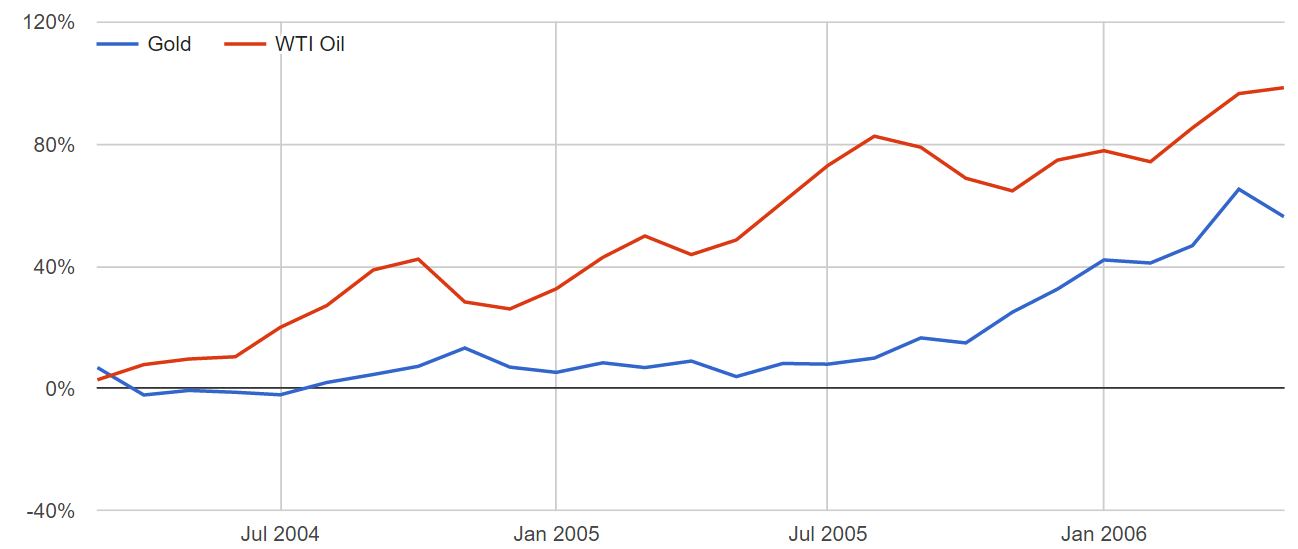

Performance of Gold and WTI Oil, March 2004 - May 2006

Just as expected, as the Fed is raising rates, the prices of real assets are rapidly increasing. Adding a small, diversified set of commodities to your portfolio mix over this timeframe would have significantly improved your performance.

Commodities: Other Positive Signals

While these relationships will tend to hold true regardless of the environment, commodities also happen to be selling at a tremendous discount right now due to a unique set of circumstances. We'll be exploring this more in-depth in our next article, but the basic story is that the dollar has gotten extremely strong over the past year and taken the price of all commodities down with it.

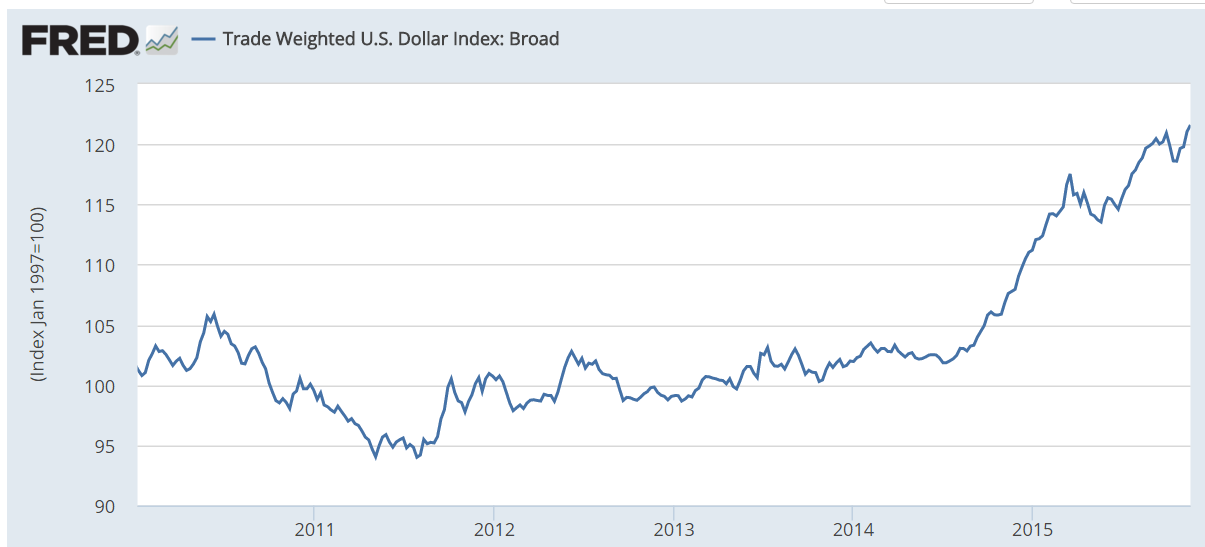

Trade-Weighted US Dollar Index: Broad, Since 2010

Meanwhile, since May of 2014, almost every major commodity is off by 20% or more. While many pundits are blaming it on a massive global recession or huge supply gluts, it's probably quite a bit simpler than that. If the dollar is 20% stronger, commodities will be at least 20% less expensive.

While we can't get into too much detail in this article, there are many reasons to believe this kind of strength in the dollar is unsustainable, especially if the Fed is worried enough about inflation to raise rates. This adds another dimension to our view of commodities as an attractive, relatively cheap asset class.

How to Determine the Right Mix, and Evaluating Other Alternatives

As to specific portfolio allocation, we recommend a relatively simple change to the traditional retirement portfolio mix: move 5-10% of both your stock and bond exposure into a basket of commodities instead. For example, a reasonable range might be 40-45% bonds, 40-45% stocks, and 10-20% commodities. This essentially creates a very effective hedge against rising rates without radically altering your portfolio or exposing it to additional, unwanted risk. If you aren't sure where to begin, you might also consider strategies like risk parity, which automatically include some exposure to commodities and intelligently adjust the percentages to account for risk.

In terms of which commodities to use, we recommend carrying an even basket of gold (SPRD Gold Shares (GLD)), oil (Energy Select SPDR ETF (XLE)), and copper (iPath Bloomberg Copper SubTR ETN (JJC)), the three most readily tradable and widely benchmarked assets. Because each is subject to its own unique set of individual market forces, it makes sense to diversify. We generally avoid broad commodity futures ETFs like the PowerShares DB Commodity Tracking ETF (DBC) because of the hidden dangers of the futures market that can wind up eating into returns over an extended period.

Other alternatives to dealing with rising interest rates include moving some money to cash, selecting specific industry sectors, or reducing your exposure to fixed income instruments specifically. Each of these options is more dependent on being correct about interest rates immediately rising, with larger consequences if that winds up not being the case. By simply adding commodities to your mix instead, you keep your general portfolio construction intact while gaining an intelligent hedge at an attractive valuation.

Caveats

If rising interest rates fail to materialize - either because of economic weakness or a lack of inflationary pressure - commodities will be unlikely to rally. Commodities are inherently risky instruments that can be complicated to understand and trade, and we recommend seeking a professional for advice if you are unfamiliar with the asset class.

Conclusion

With unemployment down to 5% and a decade of zero interest rates behind us, it seems almost certain that the Fed will begin rising interest rates shortly. Unfortunately, that leaves the traditional retirement portfolio mix of 50% stocks and 50% bonds quite vulnerable to poor returns over the next few years. Using history as a guide, adding 10-25% of commodities to your portfolio mix may be a simple and effective way to hedge out the risks of an inflationary environment without the need for market timing or more advanced tactical adjustments.

Disclosure

This information does not constitute investment advice or an offer to invest or to provide management services and is subject to correction, completion and amendment without notice. Hedgewise makes no warranties and is not responsible for your use of this information or for any errors or inaccuracies resulting from your use. Hedgewise may recommend some of the investments mentioned in this article for use in its clients' portfolios. Past performance is no indicator or guarantee of future results. Investing involves risk, including the risk of loss. All performance data shown prior to the inception of each Hedgewise framework (Risk Parity in October 2014, Momentum in November 2016) is based on a hypothetical model and there is no guarantee that such performance could have been achieved in a live portfolio, which would have been affected by material factors including market liquidity, bid-ask spreads, intraday price fluctuations, instrument availability, and interest rates. Model performance data is based on publicly available index or asset price information and all dividend or coupon payments are included and assumed to be reinvested monthly. Hedgewise products have substantially different levels of volatility and exposure to separate risk factors, such as commodity prices and the use of leverage via derivatives, compared to traditional benchmarks like the S&P 500. Any comparisons to benchmarks are provided as a generic baseline for a long-term investment portfolio and do not suggest that Hedgewise products will exhibit similar characteristics. When live client data is shown, it includes all fees, commissions, and other expenses incurred during management. Only performance figures from the earliest live client accounts available or from a composite average of all client accounts are used. Other accounts managed by Hedgewise will have performed slightly differently than the numbers shown for a variety of reasons, though all accounts are managed according to the same underlying strategy model. Hedgewise relies on sophisticated algorithms which present technological risk, including data availability, system uptime and speed, coding errors, and reliance on third party vendors.